Now the processing of return filed will be through your Aadhaar Number, where, you can link it with your PAN and get rid of sending ITR V to CPC, Bangalore.

In the new process, a one time password (OTP) will be generated after uploading your return. With the help of this OTP, you can verify your ITR filed and there will be no need to send Acknowledgement to Bangalore. From the Assessment Year 2015-16, an option is given to the taxpayer to verify their return of income via Electronic Verification Code (EVC).

In these cases, taxpayers shall not be required to send the signed copy of ITR V to CPC, Bangalore.

Before getting in details, we shall first understand what EVC is and how it can be generated:

What is EVC?

For electronic verification of return, a code (EVC) is generated. EVC will be a unique number linked to an assessee's PAN. One EVC can be used to validate one return, irrespective, of assessment year or type of return.

Note: EVC generated via Aadhaar Card will be valid only for 10 minutes and in any other case, it will be valid for 72 hours.

Can all assessees verify return through EVC?

Following cannot file return through EVC:

a. Persons, whose accounts are required to be audited under Section 44AB;

b. Political parties filing their return of income in ITR-7; and

c. Companies

How to generate EVC?

Taxpayers can generate EVC by any of the four ways given below:

1. Through e-filing website of income tax department:

This facility is available only to the assessees:

- Having total income of Rs 5 lakh or below and

- Not claiming income tax refund

- EVC generated will be sent to the registered email ID and mobile number.

2. Through net banking

If your bank is registered with Income Tax Department, you can directly access the e-filing website through your account login. EVC generated will be sent to the registered e-mail id and mobile number of taxpayer.

3. Through Aadhaar number

Taxpayers can link their Aadhaar Number with their PAN on e-filing website to generate the EVC.

After linking Aadhaar Number to PAN, 'one time password' ('OTP') will be generated by UIDAI and sent to the taxpayers' mobile numbers registered with UIDAI. This Aadhaar based OTP is the EVC and can be used to verify the income tax return.

4. Through ATM

Taxpayers can generate EVC through ATM only if ATM card of taxpayer is linked to PAN. The bank will communicate to e-filing website which will generate EVC and send the EVC to assessees on their registered mobile numbers.

After understanding all the options available for generating EVC, you must know how and when this EVC shall be used in verification process.

E- Verification of ITR is required to be done in following situations:

1. While uploading a return

2. Of an already uploaded return

Let us see how and when EVC is being used in all the situations.

1. E-Verification while uploading a return

- Upload return and click submit

- The return is uploaded. However, pending for e-verification

For e-verification, taxpayers have two options:

- I would like to e-verify now

- I would like to e-Verify later/ I would like to send ITR V

For those who choose 'I would like to e-verify now':

Step 1: Enter the EVC sent to your registered email ID / mobile number and submit to e-verify return.

Step 2: Download the acknowledgement (No further action required).

For those who choose 'I would like to e-verify later/ I would like to send ITR V'

Step 1: Click on Continue -> Download ITR V

Step 2: Submit ITR V to CPC, Bangalore.

2. E-verification of an already uploaded return

- Click e-verify return under e-file.

- Uploaded returns (120 Days) which are yet to be e-verified are displayed in a table.

- Click on e-verify (for the return already uploaded)

For e-verification, taxpayers have two options:

- I would like to e-verify now

- I would like to e-verify later/ I would like to send ITR V

For those who choose 'I would like to e-verify now'

Step 1: Enter the EVC sent to your registered email ID / Mobile number and submit to e-verify return.

Step 2: Download the acknowledgement (No further action required).

For those who choose 'I would like to e-Verify later/ I would like to send ITR V'

Step 1: Click on Continue -> Download ITR V

Step 2: Submit ITR V to CPC, Bangalore.

With this explanation about the process to verify your return filed with the department, taxpayers may simply do the verification process. After the successful verification you will not be required to do the tedious work of sending ITR V to Bangalore.

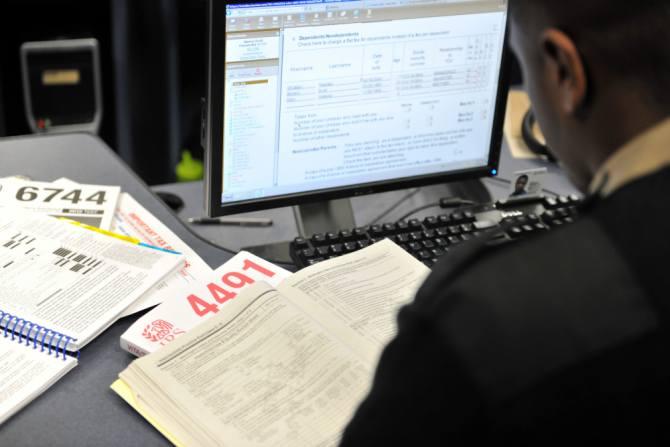

Photographs: Presidio of Monterey/Creative Commons