It's an undeniable fact that after enactment of GST, buying insurance will become a little expensive impacting your term plans, health plans and motor insurance plans the most.

But you should not ignore the importance of insuring your life, health, vehicle, says Harjot Singh Narula

Illustration: Uttam Ghosh/Rediff.com

GST is a goods and services tax, which will eliminate the cascading effect or double taxation effect on the cost of goods and services down the value chain.

Goods and Services Tax (GST) is one universal value added tax for the whole nation, which will replace the existing tax structure in India, as levied by the central and state governments in India. It will be applicable to the supply of goods and services, from the manufacturer to the end consumer.

GST Council is responsible to look after its administration. The council is chaired by the Union finance minister Arun Jaitley.

Under GST, goods and services are proposed to be taxed at a rate of 0 per cent, 5 per cent, 12 per cent, 18 per cent, 28 per cent as per the council's verdict.

GST is likely to be implemented with effect from July 1, 2017.

With the implementation of the new tax regime, double taxation on the transaction of goods and services will completely be abolished.

How will GST work?

GST will have two components: Central GST (CGST) and State GST (SGST).

Central Goods and Services Tax (CGST) will be collected by the Central Government and State Goods and Services Tax (SGST) will be collected by the State Government for intrastate sales.

IGST is also applicable and collected by the central government for interstate sales.

GST will have a mixed impact on different sectors. Automobile segment will have lower tax; FMCG will have a combined effect (cheaper and dearer); insurance industry will have a higher tax slab; home appliances will have a higher tax; cement and paints industry will have marginally higher tax.

How GST will impact the premium for different types of insurance policies?

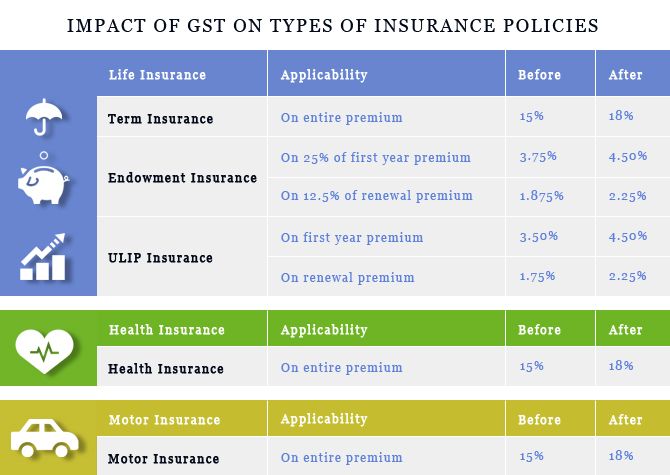

GST Council declared 18 per cent as tax rate to be applicable on the insurance sector. The hike in the tax rate is about 3 per cent (existing 15 per cent to the new 18 per cent) and it would directly be passed on to the customers, thereby creating a direct impact on the premiums of various insurance policies.

The premium paid towards your life insurance policies has two major components.

The first one is the premium component for getting risk coverage, that is, the cost of providing the death benefit and another is the investment part, that is, cost of getting the maturity benefit which is your invested amount plus returns on investment, if any.

The tax applicable under life insurance policies is levied only on the component of the premium offering risk coverage.

For non-life policies, the tax is levied on the entire premium amount, which is 18 per cent GST on the premium amount.

For life insurance policies

1. Term insurance plan

A term plan is a pure risk cover and it offers death benefit. Under this policy, your family or nominee will receive the sum assured, on your untimely demise during the term of the policy.

It provides complete financial protection to your family in case of the loss of the bread earner.

As the tax is levied on the risk part of the premium amount, the term plan's entire premium amount will now be charged at 18 per cent GST tax rate. So, getting a term plan will become costlier by 3 per cent.

2. Endowment insurance plan

Endowment plans or traditional saving plans offer death or maturity cover, whichever occurs earlier. Under this plan, your family will get the amount equal to the sum assured plus the accrued returns, in case of your unfortunate death within the policy term.

In case of your survival till the end of the policy term, the guaranteed maturity value is payable.

Under pre-GST regime, the endowment plans attracted service tax of 3.75 per cent on the first year premium; post GST implementation, it will rise to 4.5 per cent in the policy inception year.

From the second year onwards, endowment plans, which are now charged at 1.875 per cent, will be increased to 2.25 per cent with effect from July 1, 2017.

3. Unit linked insurance plan (ULIP)

ULIP provides the combined benefit of insurance plus investment. These plans are market linked and offer you the flexibility to invest with the various fund options available to generate high returns on your investment as per your risk taking appetite.

The premium component is composed of cost for offering risk coverage and investment returns.

Currently, ULIPs attract a service tax of 3.5 per cent in the first year and 1.75 per cent, second year onwards.

Post implementation of the GST, the tax rate will increase to 4.5 per cent in the first year and 2.25 per cent from the second year onwards.

For non-life insurance policies

1. Health insurance

A health plan provides the cover for you and your family against medical expenses arising due to hospitalisation. By buying a health plan, you don't have to worry about the medical bills and just focus towards recovering your health.

The tax rate for a health plan premium in pre-GST regime is 15 per cent, which will increase by 3 per cent, making it 18 per cent on the entire base premium amount.

2. Motor insurance

A motor insurance policy is of two types: 'Comprehensive Motor Insurance' and 'Third Party Motor Insurance'.

Buying a comprehensive motor insurance policy provides cover for third-party liability and the damage caused to your vehicle.

With a third-party motor insurance, you can get cover against third-party liability only arising due to property damage and/or bodily injury caused to a third party involving your vehicle.

The tax rate on a motor insurance policy prior to the GST is 15 per cent, and after implementation of the GST, it would be 18 per cent applied on the entire premium amount.

Conclusion

It's an undeniable fact that after enactment of GST, buying insurance will become a little expensive impacting the term plans, health plans and motor insurance plans the most.

But due to a surge in the premium for various insurance policies, you cannot ignore the importance of insuring your life, health, vehicle, etc. with the help of life and non-life insurance plans.

Apart from the cost component, it is vital to look for the policy benefits, coverage, inclusions and exclusions.

Harjot Singh Narula is founder and CEO, ComparePolicy.com