'Avoid going overweight on gold. But maintain a 10 per cent allocation via sovereign gold bonds,' Bajaj Capital MD Sanjiv Bajaj tells Sarbajeet K Sen.

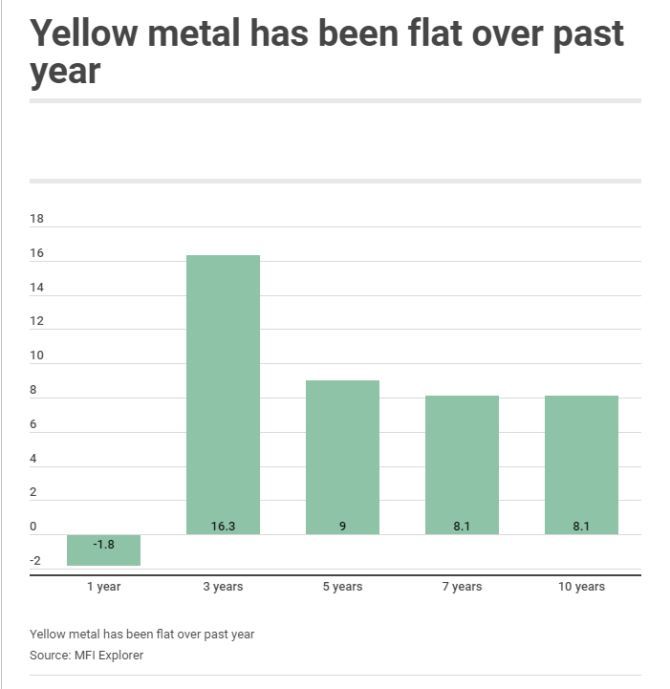

After a stellar run in 2020, gold prices have been on a downward spiral in recent months.

After hitting a lifetime high of Rs 55,922 per 10 grams in August 2020, the yellow metal is now trading at Rs 48,096, down 14 per cent from those levels.

Today economic recovery and inflation are the key factors impacting the prices of asset classes.

While there is uncertainty about the road ahead for gold, experts say investors must maintain some allocation to it.

Safe-haven demand diminishing

COVID-19 induced lockdowns and uncertainty all over the world had buoyed gold prices in the first half of the CY2020.

However, the situation changed as unlocking began in the second half.

Liquidity injected by central banks worldwide made investors go after risk assets like stocks.

Rising vaccination encouraged them to invest in stocks related to economic-recovery themes and shun gold.

"The closer we get back to normalcy, the more range-bound gold prices could remain," says Harshad Chetanwala, co-founder, MyWealthGrowth.com.

Change in Fed stance

The US Fed has said it is contemplating an increase in interest rates in 2023.

This indicates an improving macro-economic situation, which will lessen the safe-haven demand for gold.

'International gold prices plunged 7 per cent in June as the Federal Reserve signaled its intent to raise interest rates by 2023, a year earlier than planned. This announcement came in the wake of an encouraging economic recovery in the US and higher-than-expected inflation,' Chirag Mehta, senior fund manager-alternative investments, Quantum Asset Management Company, said in a recent note.

'The US economy is recovering well from the COVID-19 recession, which is not good news for gold as investors increasingly prefer higher-yielding risk assets,' Mehta added.

Can its appeal revive?

A possible third wave of the pandemic could push gold prices up.

"Most global equity indices have doubled from the lows of March 2020. And COVID-19 is still affecting our lives. The risk of a third wave cannot be ruled out. Also, the economies of most countries are still at below pre-Covid levels," says Brijesh Bhatia, senior research analyst, Equitymaster.

While gold prices have taken a beating on the expectation that interest rates may rise (gold has a negative correlation with real interest rates), this is still some time away.

Reviving their economies is still central banks' priority.

Liquidity may not dry out soon and could continue to fan inflation, which would be conducive for gold.

Also, the high valuations of equities globally make a strong case for gold.

Any correction in equities could trigger fresh purchases of gold.

Geopolitical tensions could add uncertainty to global trade, further boosting the demand for gold.

Cryptocurrency prices have turned volatile over the past three months.

This could make some investors switch back to gold.

"Gold is a cyclical and liquid asset. With uncertainty surrounding the third wave and disillusionment over cryptocurrency among investors, gold will again emerge as the preferred investment for providing stability. It could touch Rs 51,000-Rs 52,000 again by the end of the year," says Biren Vakil, founder and chief executive officer, Paradigm Commodity Advisors.

What should you do?

Investors should maintain exposure to gold based on their asset allocation strategy.

"Gold prices tend to go up sharply in times of high and runaway inflation. Such a situation is not yet there in the global or the Indian economy yet. Hence, avoid going overweight on gold. But maintain a 10 per cent allocation via sovereign gold bonds," says Sanjiv Bajaj, joint chairman and managing director, Bajaj Capital.

Chetanwala, too, says he has been advising his investors to limit their allocation to gold to 5-10 per cent of their overall portfolio.

Feature Presentation: Aslam Hunani/Rediff.com