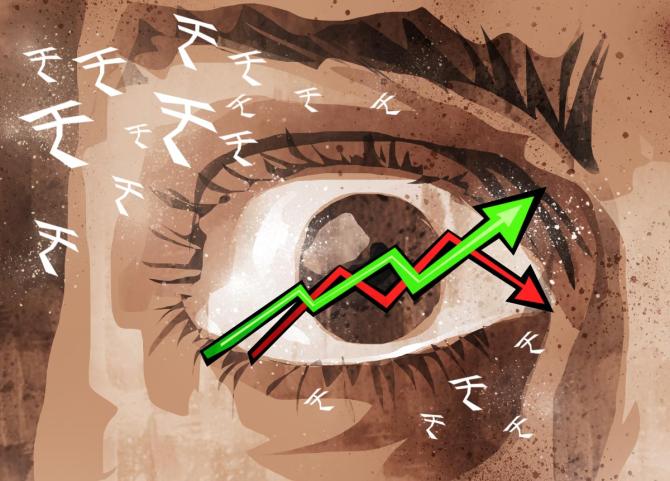

Exposure to debt funds and gold is essential even if current returns from these asset classes are low, suggests Sanjay Kumar Singh.

The new calendar year is a good time to do a thorough check of your financial portfolio.

What makes it even more crucial to do so is the change in monetary policy stances of global central banks due to which, the high liquidity and low interest rate environment that has prevailed for the past 18 months, could change.

Rebalance your equity exposure

The run-up in equity markets is likely to have made your portfolio overweight on this asset class.

"Though the equity markets have corrected slightly in recent weeks, this is still a good time to sell some of your equity holdings and return your portfolio to its long-term strategic asset allocation," says Ankur Kapur, managing partner, Plutus Capital, a Sebi-registered investment advisory firm.

Investors should check their sub-asset allocation as well.

Over the past year, mid- and small-cap funds have far out-performed large-cap funds (please see table).

This would again have made your portfolio overweight on the mid- and small-cap side, making it riskier than it should be.

So, investors need to rebalance their exposure to these sub-asset classes as well.

Financial planners say they are witnessing strong resistance among investors to booking partial profits in the winning asset class and reinvesting the gains in underperforming asset classes.

Rebalancing through selling must be undertaken if you will require the money within five years.

If you don't need the money during this period, you may try to bring your portfolio back to its long-term asset allocation by investing fresh money in the underperforming asset classes.

Maintain exposure to international funds

Even if returns from the domestic funds in your portfolio were better than those of the international funds you hold, maintain exposure to the latter.

"Allocation to global funds is important so that your portfolio is not completely reliant on one geography. Investing globally will also provide Indian investors access to asset classes and themes not easily available in India. Investors should, therefore, not be guided by short-term performance when making this decision," says Thomas Meichl, head of advisory, Kristal.AI.

With bouts of volatility expected in 2022, he suggests investors exercise discipline regarding how much they allocate to international core versus next-generation thematic portfolios.

Quality issues in direct equity portfolios

Many direct equity investors who have invested in commodity stocks have witnessed strong gains in recent months.

On the other hand, those holding quality names have seen lesser appreciation.

"Commodity stocks are driven by global demand-supply factors. Getting the timing right in these stocks will be difficult for most retail investors," warns Kapur.

Many millennial investors start off by investing in good-quality companies.

"But as greed takes over, many deviate into penny stocks. This should be avoided as it could lead to huge losses," says Nishant Kohli, founder and director, Mudra Portfolio Managers.

With the US Federal Reserve deciding to reduce liquidity at a faster pace and undertake three rate hikes in 2022, the high liquidity and low interest-rate scenario is set to change.

"Stick to quality stocks. Such a portfolio will decline less and also recover faster," says Kapur.

With market valuations at elevated levels, Kohli suggests adopting a value-oriented strategy--investing in stocks that are trading at less than their intrinsic value.

Don't avoid debt funds

Most developed market central banks have realised that their post-pandemic monetary policies have got their economies back on the growth path.

However, inflation is proving to be less transient than they had estimated.

So, most will gradually reduce adding liquidity and then raise their benchmark rates.

The Reserve Bank of India is also expected to reduce surplus liquidity in the banking system, which will result in a gradual uptrend in rates at the shorter end of the yield curve.

However, all moves are likely to be gradual so as not to upend growth.

With equities having yielded very high returns over the past 18 months, at some point mean reversion is bound to occur.

Hence, investors should take an allocation to debt funds, even though returns may remain in the single digit next year also.

In this environment, investors should stick to the strategy of matching their investment horizon with the average duration of the fund.

"The yield curve in India is very steep. Investors are getting compensated for the risk they are taking at the long end of the yield curve," says Dhawal Dalal, chief investment officer-fixed income, Edelweiss Mutual Fund.

He adds that investors will have to extend their investment duration to the 5-10-year segment to earn positive real returns.

He further adds: "Investors should opt for an appropriate target maturity fund based on their investment horizon so that they enjoy predictability of return and indexation benefit."

Kohli suggests sticking to shorter-duration funds (for those with a shorter investment horizon) and floater funds.

Longer-duration funds should be avoided by those who have a shorter investment horizon as rising interest rates could cause capital losses in these funds.

Gold: Exposure must to hedge against equities

Gold, the safe-haven asset, disappointed investors as a larger portion of the population got vaccinated, economies got back on track, and equity markets soared.

In the coming year, two factors will influence the price of gold.

"Gold has traditionally served as a hedge against inflation. That factor will have a positive impact on gold demand and prices. At the same time, the US Federal Reserve is set to taper and also hike rates in 2022. Such tightening will cause the dollar index to appreciate. Gold prices have a negative correlation with the dollar index. Risky assets like equities also continue to do well," says Naveen Mathur, director-commodities and currencies, Anand Rathi Shares and Stock Brokers.

Mathur does not expect high returns from gold in the coming year either.

Nonetheless, he suggests that investors maintain a 10-15 per cent allocation to gold in their portfolio.

"It will act as a portfolio diversifier and hedge your losses whenever the equity markets tank," he says.

Is your term cover adequate?

During the year-end check, investors should also check their insurance portfolios to ensure they and their families are adequately protected.

The quantum of sum assured is important.

"People who are up to 35 years old should have a sum assured of about 20-25 times their annual income as annual incomes tend to be on the lower side at this stage. Between 35 and 40, the sum assured can come down to about 20 times. Between 40 and 45, it can decline further to about 15 times. Thereafter, at 55, even 10 times coverage is good enough as income levels are up by then," says Indraneel Chatterjee, co-founder, Renewbuy.

Those who have got married, had children, or bought a house should also consider hiking their sum assured to take care of these added responsibilities.

While buying a term cover, compare claim settlement ratios.

In addition, pay attention to the time taken by the insurer to settle claims.

According to Chatterjee, those who are on the verge of retirement must consider purchasing an immediate annuity to safeguard against longevity risk (the risk of outliving your savings).

Check quantity and quality of health cover

Another essential aspect one must check is whether one has adequate health insurance cover.

"Most people living in metro cities should have a base health insurance cover of around Rs 10 lakh. This should be supplemented with a super top up of Rs 90 lakh," says Nayan Ananda Goswami, head-group business and retail sales and service, SANA Insurance Brokers.

It is also crucial to check the quality of the health insurance policy.

Senior citizens, for instance, should ensure they do not have a policy with copayment requirements (unless they wish to reduce the premium).

Also, check that the waiting period for pre-existing diseases is minimal.

In the wake of the Covid crisis, the cost of consumables became a big issue.

"Nowadays, many policies cover the cost of consumables either as a feature of their base policy, or offer it as a rider," says Goswami.

This is a good feature to have.

For greater protection, one may also consider a critical illness policy, a fixed-benefit plan that will make a payout if any one of the dreaded diseases covered strikes.

If no-claim bonus (NCB) has augmented the sum insured of your policy, you should not get too complacent about it. As soon as you make a claim, the NCB will get reduced.

"Nowadays you can buy a rider that protects your NCB. Some insurers also don't reduce the NCB even if you make a claim," adds Goswami.

This is another good feature you should consider acquiring.

Table: Equities have overwhelmingly outperformed debt and gold

Source: MFI Explorer; Returns are of direct, growth funds. Above one-year returns are compound annualised

Feature Presentation: Aslam Hunani/Rediff.com