If your child is already abroad, then remit money in advance.

If you plan to travel soon, pre-booking tickets, hotels and other services may prove helpful.

With the rupee depreciating around 7 per cent against the US dollar year-to-date, those planning to travel abroad, or sending their children to study in foreign colleges, will have to shell out more.

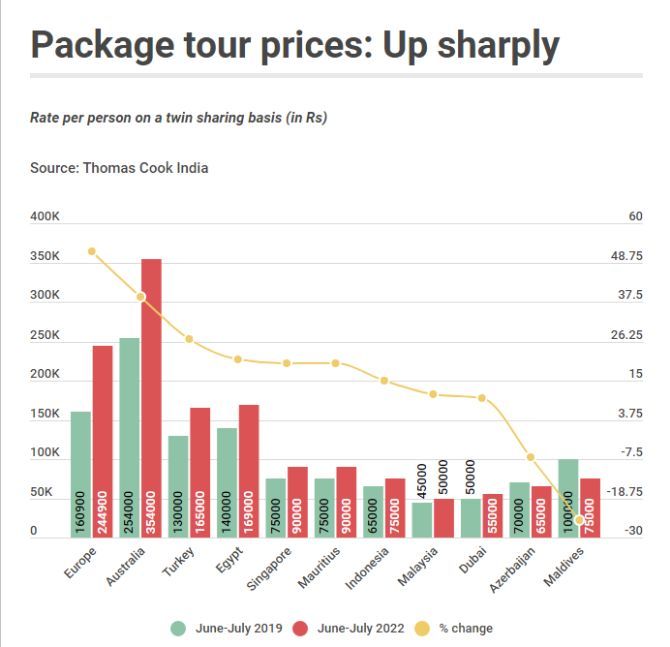

Costs are up

International tour costs are up by as much as 50 per cent compared to 2019 or pre-pandemic levels (please see table) on the back of pent-up demand, increase in airfares and on-ground charges.

Compared to prices six months ago, tour costs and air fares have become dearer due to strong demand and sharp surge in the price of crude oil, which in turn has pushed up the price of air turbine fuel.

ATF prices in Mumbai, for example, are up at Rs 140 per litre in July from around Rs 75 at the start of 2022 and from Rs 56 last April.

ATF costs typically account for 40-50 per cent of total expenses of an airline.

The international tour package price has components such as airfare, hotel, ground transport, sightseeing, meals, visa and insurance.

Airfare and insurance premiums are denominated in rupees. Visa charges are collected in rupees but are priced in a foreign currency. Fluctuation in visa fees depend on the rate of exchange (ROE).

Currently, while most visa fees remain similar to pre-pandemic levels, the overall cost of the rupee has increased due to exchange rates.

Typically, airfare accounts for 30-50 per cent of tour costs depending upon the length of stay.

"With strong pent-up demand, the supply side constraints, coupled with the increase in cost of aviation turbine fuel, we have seen an uptick in air fares," said Daniel D'souza, president and country head (holidays), SOTC Travel.

D'souza expected fares to stabilise as airlines increase capacity and routes.

An EaseMyTrip spokesperson said airfares have jumped nearly 50 per cent since 2019 due to increased fuel prices and demand.

Hotel rates too are up 10-15 per cent.

"We have not seen any significant impact on bookings as travel sentiment continues to be positive," he said.

Rajeev Kale, president and country head (holidays), Thomas Cook India, prices are unlikely to affect people's travel.

"Despite the rise in prices, our customers continue to book holidays to their favourite international destinations. This is expected to grow further. We have been receiving queries across value, affordable, luxury, and premium properties," he said.

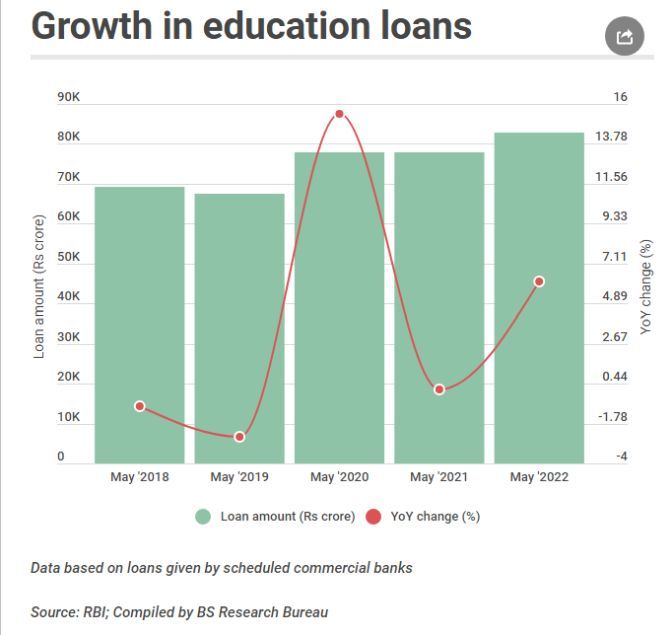

Higher education cost causes anxiety

Owing to rupee depreciation, the cost of studying abroad will also rise, even in cases where colleges have not hiked their fees.

Education consultants say that earlier they used to advise parents to be prepared for a 2-3 per cent annual increase in costs.

After the recent bout of rupee depreciation, they are advising them to be prepared for a 5-7 per cent annual increase.

Only a few parents have dropped their plans to send their children abroad.

"Of the families we work with, about 5 per cent have decided to send their child to a college in India," said Neeraj Khanna, co-founder and director of Bengaluru-based Spark Career Mentors.

Of the balance 95 per cent, he said, some that are financially strong are not worried. But among the rest, the anxiety is palpable.

"These are usually salaried professionals who have already pooled in all their resources, taken a loan, and yet are falling short," said Khanna.

Students and parents are devising workarounds. Many, who were not prepared to work while studying, now plan to work online during weekends and holidays.

Students doing their post-graduation education are looking for teaching assistantships.

Some plan not to return to India during holidays and work instead.

Avantika Singh, a Patna-based student who will go abroad soon, plans a few cost-cutting measures.

"I plan to live in a shared accommodation that is off campus, which is usually cheaper, and cook myself," she said.

When deciding on the college and country, estimate the entire cost, not just the tuition fee and accommodation cost.

Amit Yadav, chief strategy officer and chief business officer-digital business, Avanse Financial Services, said, "Before opting for an education loan, a student needs to do thorough research, estimate the total expenditure, and then apply for the appropriate loan amount."

The rupee depreciation, however, will work in favour of students on the verge of completing their courses.

Yadav said, "The rupee depreciation will work in favour of students who are currently studying in the US and plan to secure a job that pays in dollars. They will have an easier time repaying their education loan."

If your child is already abroad, then remit money in advance. Waiting may raise the cost if the rupee depreciates further versus the US dollar.

Similarly, if you plan to travel soon, pre-booking tickets, hotels and other services may prove helpful.

If your goals are long-term, then invest in assets that can provide a hedge against depreciation.

"Have 15-20 per cent of your equity portfolio in international mutual funds. Also have 5-10 per cent of total portfolio in gold," said Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisers.

These assets can provide a hedge against the rupee's depreciation.