Dwaipayan Bose on how index funds play a key role in the diversification of portfolios and help manage risks.

Index funds are passive mutual fund schemes that track an equity or debt market index.

Unlike actively managed mutual fund schemes, index funds do not aim to beat the market benchmark index. Index funds simply aim to replicate the returns of the index subject to tracking errors.

Index funds are very popular in developed markets. They are also becoming increasingly popular in India, especially since the outbreak of the COVID-19 pandemic.

As per AMFI data, in the last 4 years, assets under management (AUM) in index funds have multiplied nearly 16 times from Rs 11,000 crore to Rs 175,000 crore at a CAGR of nearly 100 per cent (as of 30th June 2023).

Diversification across asset classes

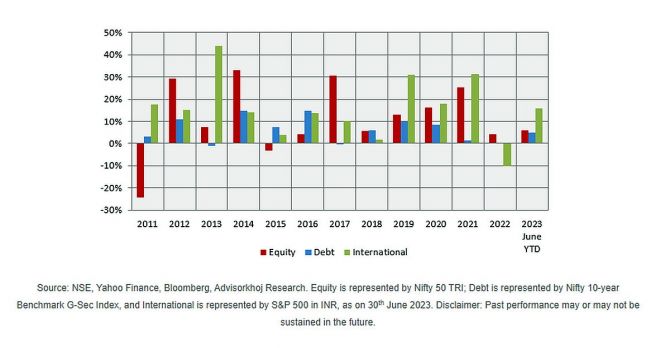

Asset allocation is a strategy to diversify your investment across different asset classes. Different asset classes, like equity, debt, international equity etc, have different risk/return characteristics.

By investing across different asset classes, you can balance risk and return. Asset allocation will reduce your portfolio risk and keep you disciplined in your investments. Through index funds, you can diversify across different asset classes at a low cost:

- Equity Index Funds track equity market indices (Sensex, Nifty, Bank Nifty etc)

- Debt Index Funds track debt market indices (e.g. G-Sec and/or SDL indices with target maturity dates)

- International Index Funds track international indices (NASDAQ, S&P 500 etc.)

There is a low correlation between the returns of different asset classes in different market conditions (see the chart below). Asset allocation will reduce the overall portfolio impact of adverse market events and bring stability to your portfolio.

Diversification within asset classes

Index funds enable you to get true diversification because you invest in the entire universe of securities belonging to a sub-category (constituting the market index) of a particular asset class.

For example, when you invest in midcap or small-cap index funds, you will get exposure to all the midcap stocks or all the small-cap stocks in the index -- a Nifty Midcap 150 index fund will provide you exposure to 150 midcap stocks, a Nifty Small Cap 250 index funds will provide you exposure to 250 small-cap stocks.

An actively managed equity fund, on the other hand, will have exposure to 55 to 60 stocks.

You can get diversification without any unsystematic risk through index funds, unlike active funds. In order to beat the benchmark index, the fund manager of an active fund will have to be overweight or underweight on certain stocks in the index. This will result in unsystematic, stock- or sector-specific risks.

Unsystematic risk is an additional risk in investment over and above market risks. There is no unsystematic risk in index funds. Index funds are only subject to market risks. In other words, the overall risk is lower in index funds.

Diversification across investment strategies

Different fund managers have different investment strategies, e.g. growth, value, growth at a reasonable price (GARP), quality etc. However, there may be human biases in active investment strategies. Index funds tracking strategy indices provide low-cost investment opportunities for different investment strategies based on a quantitative model, free from human biases.

Strategy indices are constructed based on quantitative, rule-based investment strategies -- dividend yield, momentum, value, low volatility, high beta, alpha, quality etc.

Index constituents are selected based on defined quantitative models. Strategy indices can be based on a single-factor model -- dividend yield, momentum, high beta, low volatility etc., or multi-factor models combining Quality, Value, Alpha and Low Volatility.

Examples of multi-factor strategy indices are Nifty 50 Value 20, Nifty Alpha Low Volatility 30 etc. You can tactically allocate a portion of your portfolio to strategy indices to diversify your portfolio and returns.

Diversifying your fixed income portfolio

Retail investors have traditionally favoured Bank FDs for a large part of their household savings and still continue to do so (source: RBI Household Financial Savings, September 2022).

Target Maturity Index Funds can be effective alternative investment solutions for such investors. Target maturity index funds are open-ended passive debt mutual fund schemes that track an underlying bond index and have defined maturity dates.

All the bonds in the index mature on or before the maturity date of the index. For example, the underlying bonds of the Nifty G-Sec Octpber 2028 Index will mature on or before October 2028. The benefits of investing in target maturity index funds are as follows:

Simple structure and relatively high visibility of returns

- If you hold a target maturity fund until maturity, your returns will equal the Yield to Maturity (YTM) adjusted for the fund expenses (TER).

- The yields of target maturity index funds over the maturity period are likely to be higher than Bank FD interests since they are market-linked schemes.

- Very high credit quality since target maturity funds only invest in G-Secs, SDLs and PSU bonds.

- High liquidity, since you redeem units target maturity index funds at any time with the AMC at prevailing NAVs.

- Diversification to international markets.

Index funds provide convenient investment options for exposure to international markets. International investments have several benefits:

Diversifying single country risk.

- The low correlation of returns of different markets reduces portfolio volatility

- Provides exposure to global megatrends -- especially in areas of advanced technologies that are not yet mature in India.

- Benefit from depreciation of the Rupee.

Summary

Both active funds and index funds can play important roles in your portfolio. Your core portfolio can comprise both active and index funds. Index funds can be cost-effective and convenient investments to provide diversification to your investment portfolio.

Now, there are many investment options in index funds. You should always invest according to your risk appetite. You should consult with your financial advisor or mutual fund distributor about which index funds are suitable for your risk appetite and investment needs.

Disclaimer: Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Disclaimer: This advisory is meant for information purposes only.

This advisory and the information in it does not constitute distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article or an attempt to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk.

Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Dwaipayan Bose leads content production and mutual fund research at