'From a risk-return perspective, large-cap funds may generate lower-than-historical average returns in 2024, whereas mid-, and small-cap funds hardly have any upside left.'

Amid stretched valuations and lack of positive triggers, analysts suggest investors lower their return expectations from mid-, and small-cap equity mutual funds in calendar year 2024.

They rather suggest investors rotate funds to large-cap equity mutual funds this year for relatively better returns.

"The valuation of mid-, and small-cap cohorts isn't very comfortable. Most of the positives are priced-in, and a large number of stocks are trading above their intrinsic value. By comparison, few large-cap stocks are trading at reasonable valuations," said George Thomas, fund manager-equity, Quantum Mutual Fund.

"So, from a risk-return perspective, large-cap funds may generate lower-than-historical average returns in 2024, whereas mid-, and small-cap funds hardly have any upside left," Thomas added.

Driven by massive foreign fund inflows, stable macroeconomic indicators, and robust earnings momentum, the domestic equity market clocked its best annual return, in calendar year 2023, since 2017.

The benchmark Nifty 50 surged 20.1 per cent, while the S&P BSE Sensex jumped 19 per cent.

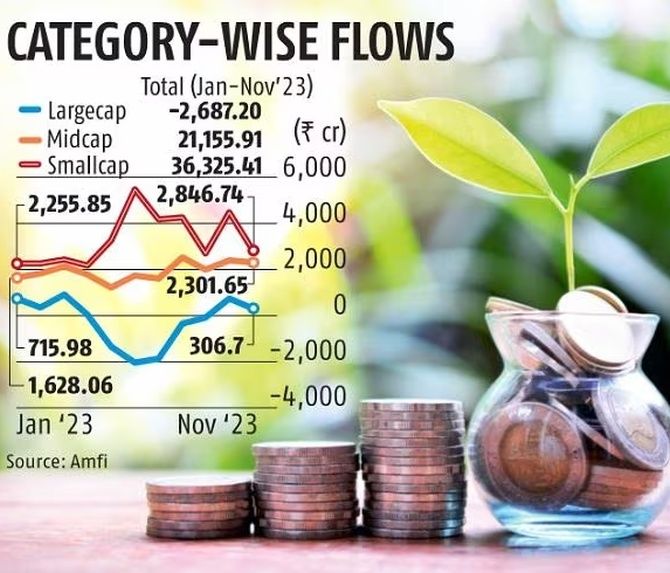

Yet, the LargeCap Equity MF category saw outflow of Rs 2,687.2 crore (Rs 26.872 billion) between April and November 2023, according to data provided by Association of Mutual Funds in India (Amfi).

By contrast, the Nifty MidCap index soared 46 per cent, and the SmallCap index zoomed 48 per cent in 2023.

Subsequently, the MidCap Fund category saw inflow of Rs 21,156 crore (Rs 211.56 billion), while the SmallCap Fund category saw inflow of Rs 36,325 crore (Rs 363.25 billion) till November 2023.

Driven by the flows, the cumulative share of flows into small and mid-cap categories over the past three years now stands at 28.3 per cent as against AUM (asset under management) share of 19 per cent, as per Amfi.

As of December 6, 2023, the average one-year return for 23 small-cap funds stood at 32.68 per cent, Amfi data suggests.

In contrast, 30 large-cap funds and 28 mid-cap funds delivered average one-year returns of 15 per cent and 28.02 per cent, respectively in the same period.

Sell-off ahead?

The sharp outperformance of small, and mid-caps during 2023, analysts said, has led to valuations becoming a challenge now.

At 27x 1-year forward price-to-earnings (PE), the Nifty MidCap100 index trades at 35 per cent premium to its average valuations as against a less than 20 per cent premium for the Nifty50.

Meanwhile, on a 12-month trailing basis, the Nifty50 is trading at 23.4x PE.

"We are starting 2024 with above average valuations, accompanied by a strong earnings cycle. Valuation is comfortable for large-caps. But, there is little margin of safety in the broader market categories," said Amit Premchandani, senior vice president and fund manager –equity, UTI AMC.

As the margin-driven uptick in earnings mean reverts, mid, and small-caps may see a phase of consolidation, he added.

FPIs make a comeback

That apart, analysts expect the return of foreign portfolio investors, who predominantly hold stakes in large-caps, to drive higher flows into the category.

CY-2023 saw net buying by FPIs to the tune of $20 billion (Rs 1.71 trillion), which came after two weak years for foreign flows.

As India's relative positioning is still light in emerging market portfolios, the rising size is making Indian markets much more relevant for global mandated funds.

Thus, structural positives such as the expected political stability, rising investment cycle, multi-year growth visibility, and peaking of US dollar may drive higher foreign flows into large-caps in 2024.

Against this, analysts at Jefferies believe the small/mid-cap space is susceptible to a sell-off, and/or a budget-driven scare in capex spends can drive a shift to the large caps early in 2024. Within the large caps, they are overweight on Financials, primarily banks.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Feature Presentation: Rajesh Alva/Rediff.com