SIP top-ups are especially beneficial for young investors, who may start with a small SIP installment and grow it over their working careers, says Dwaipayan Bose.

What is Systematic Investment Plan?

SIP or Systematic Investment Plan is a method of investing a fixed amount, regularly (monthly, quarterly, etc) in open-ended mutual fund schemes.

SIP allows you to buy the units of your selected scheme on a date chosen by you at regular intervals. The SIP amount gets auto-debited from your bank account and invested in the scheme.

There are numerous benefits of SIPs:

- You can start investing in mutual funds with relatively small amounts from your regular savings

- SIP keeps you disciplined in investing because do not need to time the market.

- You can benefit from the power of compounding over long investment tenures by investing in SIPs.

- With SIPs you can take advantage of market volatility through Rupee Cost Averaging.

What is SIP top-up?

SIP top-up is a facility by which you can increase your SIP installments at regular intervals -- half yearly, annual etc. You can specify the SIP increment either in rupees or in percentage terms.

Let us assume that you have a monthly SIP of Rs 10,000 in a mutual fund scheme. If you opt for Rs 1,000 SIP top-up on an annual basis, your monthly SIP installments will be Rs 11,000 after one year and Rs 12,000 in the following year and so on.

If you opt for 10 per cent SIP top-up on an annual basis, your monthly SIP installments will be Rs 11,000 after one year and Rs 12,100 in the following year.

How does SIP top-up work?

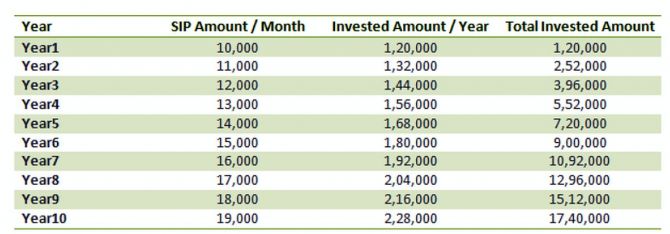

Let us assume you start a monthly SIP of Rs 10,000 in an equity mutual fund scheme for 10 years. You opt for a SIP top-up facility with annual increments of Rs 1,000.

If you did not opt for SIP top-up, then your cumulative investment over 10 years would have been Rs 12 lakh (Rs 1.2 million; Rs 1.2 lakh per year multiplied by 10 years).

The table below shows your yearly cash flows with SIP top-up.

Note: Numbers in the table are purely illustrative for investor education purposes only

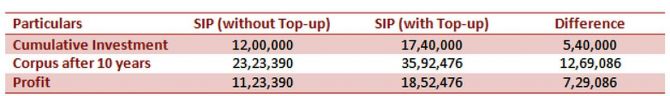

Let us now see how much you could accumulate in your mutual fund scheme over 10 years with and without SIP top-up. Let us also assume that the scheme gave 12% CAGR returns over the investment tenure.

You can see in the table below that with an additional investment of Rs 5.4 lakh, spread over 10 years, you create additional wealth of nearly Rs 12.7 lakh.

In other words, you could nearly get Rs 7.3 lakh extra profit due to SIP top-up.

Note: Numbers in the table are purely illustrative and are meant for investor education purposes only

Why should you do SIP top-up?

Our income usually increases over time. Apart from your regular annual increment, your salary will also increase as you get to senior roles in your organisation. As your income increases, your savings also increase, accordingly your investments should also increase.

In a regular SIP, your monthly investment is fixed even though your income may have increased considerably. Let us assume you are investing through a monthly SIP of Rs 10,000 and you are getting average annual increment of 10 per cent. In 7 years, your salary would have doubled but your monthly investments remain the same.

Using a SIP top-up facility you can increase your monthly investments in line with your increase in income.

How SIP top-up helps in wealth creation versus regular SIPs?

We will understand this with the help of an illustration.

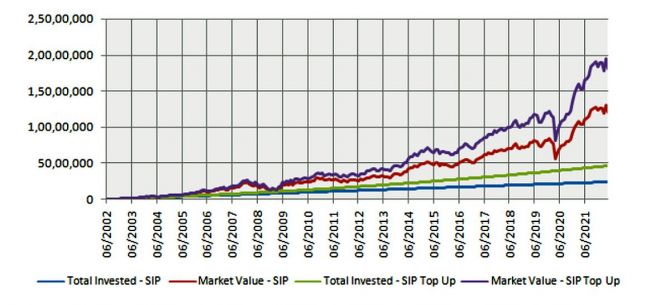

Let us assume that Investor A invested in Nifty 50 TRI over the last 20 years (ending May 31, 2022) with a monthly SIP of Rs 10,000.

Investor B also started investing in Nifty 50 TRI 20 years back with a monthly SIP of Rs 10,000 but he opted for an annual SIP top-up of 10 per cent.

In total, A invested Rs 24 lakh while B invested Rs 46.8 lakh.

As on May 31, 2022, A’s corpus was Rs 1.2 crore, while B’s corpus was Rs 1.8 crore. This illustrates how SIP top-up helps in higher wealth accumulation over long investment tenures.

Source: National Stock Exchange, Advisorkhoj Research. Period: 03.06.2002 to 31.05.2022. Disclaimer: Past performance may or may not be sustained in the future

Conclusion

SIP top-ups automatically increase your investments with increase in your income. SIP top-ups are especially beneficial for young investors, who may start with a small SIP installment and grow it over their working careers.

SIP top-ups can lead to higher wealth creation and achieve financial goals faster, for example, early retirement. SIP top-up is good investment option to achieve your long term financial goals.

You should consult with your financial advisor to learn more about SIP top-ups and how it can benefit you.

-

Do you have investment related questions? Ask rediff's Money Gurus HERE.

Disclaimer: This advisory is meant for information purposes only. This advisory and the information in it does not constitute distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article or an attempt to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Dwaipayan Bose leads content production and mutual fund research at