I am sure all of you might be quite relaxed by now with your risk management in place. Now it's time we move on to the next leg of financial planning: investments, the most interesting area for every individual.

I have come across many individuals whose only area of interest has been investments. I mean everyone likes to see money grow. In fact most of the individuals think financial planning is the same as investment planning.

Nothing can be far from the truth and I am sure by now all of you who have read the Part 1 and Part 2 of this series will agree with me. Investment planning is a part of financial planning but comes only at the third stage.

Risk management always takes priority before investing for your goals. Once that is in place, we can safely move ahead.

The writer is a certified financial planner and can be reached at dhanplanner@rediffmail.com.

Why do we invest?

Of course to save money and earn returns!

For what?

Your obvious answer would be: for my and my family's future. If asked to elaborate, I am sure you will find it difficult to list down five things for which you are saving money.

But if the investments or the money you are saving is not invested in right investment avenues then in the hour of crisis you either have invested in a locked-in financial product or their value has become half or in a product which rates very low in liquidity (like real estate). So the right type of investment product is very important to help your money grow and in achieving your goals.

So this is where investment planning comes in place. Investments of your hard earned money should always be done considering your goals and the time frame in which you want to achieve your goals.

The next question is how to go about it. First you need to start with charting, that is, writing down your goals and the time frame in which you would like to achieve them. This forms the base of your investments. To make the task simpler, you can break down your goals into three different sections:

We live only once and so no dream is too big or far-fetched.

The next step is the time frame in which you would like to achieve it. Let me explain the importance of this via an example.

Let us say you want to save for a down payment for the dream car, which you are planning to buy after a year and a half. You start saving by investing regularly in equity mutual funds. After a year, just nearing the time frame you have set for yourself, you decide to redeem the investment and the market crashes. Forget the profit, your initial investments too has halved in value.

Equities are good investments but only when you have the time frame of more than eight years. Then you can be rest assured that your investments will earn on an average 13 per cent to 15 per cent return.

Moral of the story: Your investment products should be selected on the basis of the time frame within which you would like to achieve the goal. I know it may be difficult to list down a time frame but even an approximate figure will do.

Once your goals and time frame is in place you need to put a figure or an amount that you would like to spend for that particular goal at today's value. Say for example, one of your goals is to save for your child's higher education, which is 15 years from now. You are willing to spend Rs 3 lakh in today's value. To this will be added inflation which in layperson's terms means what you will get in today's date for Rs 100, you will have to spend Rs 275 after 15 years taking into consideration an inflation rate of 7 per cent.

We cannot forget inflation as the amount, which we will derive after taking into consideration inflation, is the amount you will have to spend. Also, keeping in mind this amount you need to plan for it.

So for the same goal, which will cost you Rs 3 lakh in today's date, you will have to spend Rs 8,27,709 after 15 years taking into consideration 7 per cent inflation rate.

How did we arrive at this figure?

Future value = Present Value * (1 + inflation rate) ^ Number of years left to achieve your goals.

Hence, future value = 3,00,000 * (1 + 7 per cent) ^ 15

Therefore, future value = Rs 8,27,709 (approximately).

And that is the amount for which you need to plan.

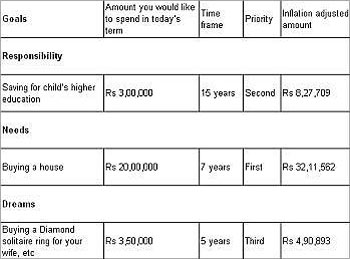

An easy way to do this is to prepare a table, which will help you in listing your goals along with a fixed time frame, priority, value and the future inflation adjusted cost. Have a look at the table above (the table is hypothetical. The values mentioned here may differ from individual to individual).

Note: If you are married, it is important that you involve your spouse when you list down the goals as even your spouse may have her/his own goals, which they would like to achieve. Also it has to be a joint effort so nothing is missed out.

The above process will help you to realise how much you need to save. The different investment avenues available are:

Equity: You can safely invest in them (that is, direct equities or equity mutual fund) if your time horizon is for more than 8 years. You can also invest in them if your time horizon is more than 5 years but the exposure should be limited. Remember one thing, though: even in the long term, that is, more than 8 years as you near the realisation of your goal, you must systematically transfer your money from equity to debt. So this way you not only protect your capital but also your profits.

Debt: If your time frame is five years, debt is for you. The return is less but you can be sure that in products like fixed deposits, your capital will be safe.

Gold: At least 5 per cent of your portfolio has to be in gold. Gold is safe haven especially when there is crisis in the world. But be very clear about one thing: jewellery does not account for investments. Investments in gold have to be in the form of gold coins or bars. Gold exchange traded funds (ETF) is also a good form of investments.

Real estate: Property has always been good a form of investment. The only problem is the amount of investment required and the liquidity. Take for example in today's market where real estate prices have gone down, it is a good buyers' market but for sellers in dire need of cash, they will have to break the rates and sell at a discounted price.

A professional advice for selecting the right investment avenue is always advisable.

For starters my advice would be to start doing this exercise. Once this is in place, we will move ahead with your retirement planning in the next series. Until then happy goal setting!