Christmas and New Year are around the corner bringing the holiday cheer and festive spirit into your lives. It's very tempting to go shopping, splurge money, buy gifts for loved ones and have a merry time.

Marketers too bombard us with gift suggestions on a daily basis, whether it is through the Internet, e-mail campaigns, radio, newspapers, television, or the beautifully decorated window displays and inviting promotions in stores. Big hoardings across the city keep shouting at us to buy while restaurants and brightly lit shopping malls lure us to spend.

All of this combined with a lack of time and planning can lead us to get carried away with holiday spending.

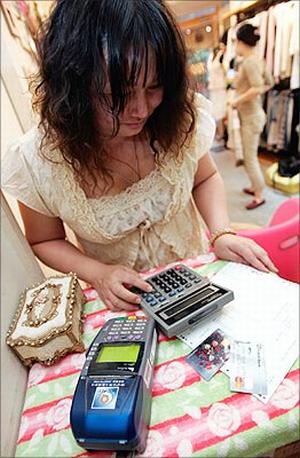

Credit cards can make the task of shopping convenient, quick and easy. However, a credit card can either be your best friend or worst enemy depending upon how you use it.

Click NEXT button to proceed.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

There are certain advantages of using credit cards to finance your expenditure:

But if let loose your credit card can wreck havoc and get you into an expensive debt trap. You need to overcome the temptation of spending as credit cards can make you spend more than you want.

Click on NEXT for some tips you must keep in mind to avoid falling into a debt trap this festive season:

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

One psychological aspect of using a credit card instead of a debit card/cash is that you don't feel you're spending real money.

The pleasant feeling you experience while shopping is disconnected from the unpleasant or painful feeling of making the real payment.

But the sudden realisation comes with the credit card statement.

Budget

Prepare a basic budget for the festive season and earmark some funds starting a few months in advance. The budget should fit into your overall financial situation and you should be determined not to overstep it.

You might end up going to restaurants and shopping malls and having a budget will allow you to make appropriate choices to stay within your spending limit.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

Start in advance.

Make a list of all the things you want to buy for your friends and family. Start looking around for deals and discount sales. Once you find a good bargain keep accumulating the gifts.

This way it evens out your spending rather than burning a big hole in your pocket at once.

Use debit cards

It is advisable to use debit cards for making transactions as you will be using only the money you have in your bank account. You tend to spend lesser using a debit card as you know that the money is getting debited directly.

Credit cards make you spend more. There are a lot of studies which have confirmed this. Keep your credit card tucked inside for emergency purposes.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

Think in terms of net worth which can be done by adding all your assets and subtracting all liabilities.

Your spending during festivals is on items like clothing, gifts, eating out, travelling etc. which don't add to your assets. By using a credit card you are creating what is called 'consumer debt' which adds to your liability and bring down your net worth.

It is good to have a gala time during festivals and holidays but make sure you don't get debt-ridden afterwards.

Your debt vs your income

Do a calculation of how much debt you have as a fraction of your monthly post tax income. Anything above 20 per cent to 25 per cent is a bad signal.

If you already have debt outstanding don't make additional expenses without clearing the old dues. The interest calculation on credit cards is tricky.

Minimum payment trap

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.