As 2009 draws to a close we present to you some New Year Resolutions for 2010 which will go a long way in making you financially fit. All you need is will power and determination to follow these simple tips.

1. Articulate your goals

Make sure you have clear and concise financial goals put down. This would help you to shape out how your investments for the year ahead should be. Unless you know what you want and where you want to be, you will not be able to direct your investments into something useful. It is best to list small, attainable goals rather than go for a lifestyle change overnight. By giving yourself simple tasks that you can even complete in five minutes, once a day, you will make headway over the course of time.

2. Decide your asset allocation

A lot of people make investments in an ad hoc manner especially to save taxes in the last months of financial year. It results in portfolio which is heavily skewed towards debt and low-return instruments -- FDs, PPF, endowment policies, NSCs, debt options in ULIPs. All these have fixed or low-returns, thereby making them unsuitable options if you are investing with a horizon of 15 -20 years or more.

Young people should do an asset allocation based on their age, risk profile and time horizon and then start making investments. For a longer horizon the exposure to equity should be higher especially if you are in 20s.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

This is an area that is omitted from most peoples' lists, but it should be a top priority - protect your loved ones. What happens in the event of a death or disability? Will the family be comfortable financially? Will the children be able to go college? Most people's greatest financial asset isn't their home or investment accounts; it is the ability to earn money. It is necessary to protect against this asset being prematurely taken away.

4. Create a budget

Determine your income and expenses for each month by reviewing your bank statements, credit card bills and receipts for the last year. Record actual results regularly and update your plan quarterly. This will reveal where your money is being spent and provide information you need to manage it correctly. This will also help you to provide for big expenses which arise during some months like a festival or a short holiday.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

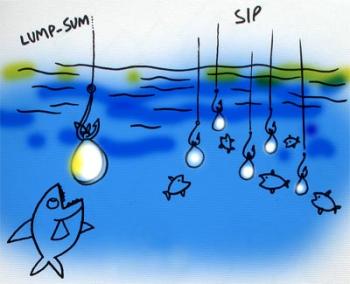

Saving early for long-term expenses such as retirement or your kids' college expenses allows you to capitalize on the most important investing force: Time. Start a systematic investment plan and make sure that your savings are routed in to long term investments. This way, you are forced to save because the cash is drawn directly from your bank before you can get your hands on it.

6. Be prepared for emergencies

Emergencies arise. Cars break down, ankles are sprained, and jobs are lost. It would be ideal to set aside three to six months of living expenses as a regular reserve. This fund will cover those inevitable, unexpected costs and keep you from borrowing money when they occur. Make sure you and your family has adequate health insurance so that you are not bogged down by a financial crunch during a sudden medical emergency.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

In the long run slow and steady wins the race. Try to be a regular and disciplined investor. Even the best of investors and stock market veterans have repeatedly failed to predict what's going to happen next. The recent crash and then sudden surge in the market is an example to prove this. As retail investors this task becomes even more difficult. SIP and rupee cost averaging are great techniques to invest regularly and have a great return over longer horizon.

8. Contribute to your retirement plan

Look at your salary slip and see how much money you are contributing to the EPF (Employee Provident Fund). Make sure you maximise it and keep it going. Over 15-20 years the power of compounding will do its magic and it will grow into a decent corpus. PPF is another good option for investing extra money for retirement purpose. It offers tax benefits as well.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

Lack of documents and records can hamper your tax filing process and you may not be able to claim all benefits. Maintain records of all important transactions in a systematic manner. You can use the age old system of maintaining documents in files or use the new age budgeting and other online software. Good record keeping also help you in collating and analysing how you spend and invest.

10. Pay your credit card dues

Pay all credit card balances in full each month. Leaving a balance on a credit card account will leave you susceptible to very high interest rates. Having balance on credit cards is the beginning of debt trap. Control your urges to spend and try to spend using debit card or cash so that credit card debt is avoided.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

One fails to realise that the wrong financial advice, and thus the wrong financial advisor, could be costing you lots of money every year. Do you know how your advisor is compensated? How does that compare to other advisors? Do they have the expertise you need? Even if you prefer to do things yourself, the occasional check up from an advisor may provide you with some valuable tips.

12. Money isn't everything

Remember health, family and happiness are as important so do not neglect these aspects. Another very important thing to realise is your investments in skill accumulation. If you keep enhancing skills related to work, you can probably get a better job, faster promotion and chance to earn more money.

Take a deep breath and think about how you can move up the ladder. It may mean doing new certifications, improving soft skills and learning to manage human relationships better. This will probably be your biggest investment in the New Year.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.