If you're like most people, you probably made some resolutions for the next year. These resolutions typically include physical, mental and spiritual improvement. Some common resolutions include losing weight, eating better, exercising etc. Not many people resolve to reduce their taxes; save for retirement; and take insurance, but we shouldn't forget about financial fitness in our New Year's resolutions.

Make 2010 different!

What can you change this year? What decisions do you need to make differently to be able to look back on 2010 with a renewed sense of accomplishment? Whatever you here is a list of six financial resolutions to help you make better, smarter financial decisions both for the coming year, and for the rest of your life.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

Make sure you have clear and concise financial goals put down. This will help you to shape out how your investments for the year ahead should be. Unless you know what you want and where you want to be, you will not be able to direct your investments into something useful.

It is best to list small, attainable goals rather than go for a lifestyle change overnight. By giving yourself simple tasks that you can even complete in five minutes, once a day, you will make headway over the course of time.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

This is an area that is omitted from most peoples' lists, but it should be a top priority -- protect your loved ones. What happens in the event of a death or disability? Will the family be comfortable financially? Will the children be able to go college?

Most people's greatest financial asset isn't their home or investment accounts; it is the ability to earn money. It is necessary to protect against this asset being prematurely taken away.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

Determine your income and expenses for each month by reviewing your bank statements, credit card bills and receipts for the last year. Record actual results regularly and update your plan quarterly. This will reveal where your money is being spent and provide information you need to manage it correctly.

This will also help you to provide for big expenses which arise during some months like a festival or a short holiday.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

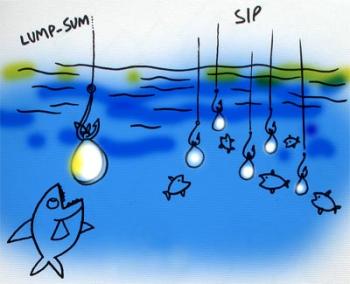

Saving early for long-term expenses such as retirement or your kids' college expenses allows you to capitalise on the most important investing force: time. Start a systematic investment plan and make sure that your savings are routed in to long-term investments. This way, you are forced to save because the cash is drawn directly from your bank before you can get your hands on it.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

Emergencies arise. Cars break down, ankles are sprained, and jobs are lost. It would be ideal to set aside three to six months of living expenses as a regular reserve. This fund will cover those inevitable, unexpected costs and keep you from borrowing money when they occur.

Make sure you and your family have adequate health insurance so that you are not bogged down by a financial crunch during a sudden medical emergency.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

One fails to realise that the wrong financial advice, and thus the wrong financial advisor, could be costing you lots of money every year? Do you know how your advisor is compensated? How does that compare to other advisors? Do they have the expertise you need? Even if you prefer to do things yourself, the occasional check up from an advisor may provide you with some valuable tips.

Granted, it may take more than a year to get through all the resolutions mentioned here, so just start with one. The important thing: it's a new year and a fresh beginning -- don't make it just like the last one -- unless of course the last one went just right. Start working today on these suggestions and within a year you'll be well on your way to achieving the financial fitness you've always desired.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.