Diversification is the key to achieve optimal risk-adjusted returns. This can be achieved across asset classes and even within a single asset class like mutual funds (MFs) that provide a range of options with differing risk profiles. Often, one is confused whilst deciding on the number of MFs / asset management companies, that one should consider holding in her/his portfolio.

The factors that need to be considered in diversification are:

Click NEXT to know how you can design your own MF portfolio.

Here are few tips on how one should go about designing your mutual fund portfolio:

Risk appetite

Often in the rush to achieve quick bucks, investors indulge in 'high-risk' funds. So it is very important to define your risk appetite at the very start of your objective to invest. Often, you tend to over-estimate risk appetite, hence, you require to be prudent while determining the risk appetite.

Ideally stay within the 'low-moderate' group as you start out your investment in MFs.

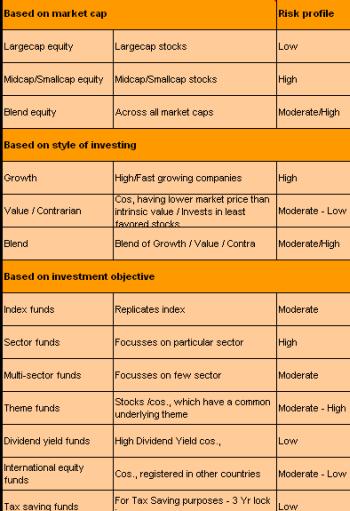

Assess the type of funds and invest

Prior to investing, assess the category / type of funds. There are a host of funds within the equity funds gamut, there are various types of categorisation, the same is mentioned in the adjacent table.

NFOs: Think before you leap!

NFOs (New fund offers) were the flavor of the season when the going was good. Off late we haven't seen too many of these.

Investors normally, are awed by the fact that they are getting to buy a fund at Rs 10 NAV (net asset value), which according to them is a steal! Often you invest in too many NFOs, irrespective of whether they complement your portfolio or not!

Always look at the returns while evaluating a fund. NAVs do not indicate a thing about the potential of the fund. In fact, most investors who frantically accumulated NFOs when the markets were at all time highs have lost much higher than those who invested in existing MFs.

A fund with a proven track record is likely to show stability during a downtrend than a new entrant in the market.

NFOs: Think before you leap!

NFOs (New fund offers) were the flavor of the season when the going was good. Off late we haven't seen too many of these.

Investors normally, are awed by the fact that they are getting to buy a fund at Rs 10 NAV (net asset value), which according to them is a steal! Often you invest in too many NFOs, irrespective of whether they complement your portfolio or not!

Always look at the returns while evaluating a fund. NAVs do not indicate a thing about the potential of the fund. In fact, most investors who frantically accumulated NFOs when the markets were at all time highs have lost much higher than those who invested in existing MFs.

A fund with a proven track record is likely to show stability during a downtrend than a new entrant in the market.