| « Back to article | Print this article |

Should you invest in stocks now?

What is the most important criterion you follow when you go shopping for clothes? Comfort level, isn't it? While most people rate comfort as the highest criteria as far as their wardrobe purchases are concerned I wonder if it is the same when it comes to your investments?

People and their mindset

My neighbor, Ramlal, who is all of 37 and working with an MNC is an ardent fan of fixed deposits. He has most of his investments in fixed deposits or in retirement funds (Provident Fund/ Public Provident Fund) as he has a particular hatred towards equities. In short, fixed deposits is Ramlal's comfort zone and stocks, it may be safely presumed, is his discomfort zone.

When the markets fell to 7,700 levels (the BSE Sensex touched an intra-day low of 7,697 on October 27), there was indeed no end to his ranting. He felt vindicated over his fixed deposit obsession.

For all the equity investors, he had one golden question: Are you making enough wealth or you need some advice on how to invest in fixed deposits?

When he posed this question to me, I told him, this was a buying opportunity and my investments then would give me best returns over the next three to five years.

He mocked at me for my confidence in a system which had failed for good this time; he had gathered some analyst reports which had spelt doom for the stock markets, and it was just a matter of time before all our equity investments vanished into thin air which would then actually take a decade or two to break-even.

He also added, that banks were providing as high as 11.5 per cent (this was in October 2008 and since then most banks have pared down the interest they pay on FDs; nevertheless, the returns, though taxable, are almost risk-free) per annum returns on fixed deposits and I should move all the equities (in losses) to FDs.

A CFA-PGDBA, Anil Rego is the founder & CEO of Right Horizons (http://www.righthorizons.com/), an end-to-end investment advisory and wealth management firm.

When the going gets good

Well all I can say is it's happening now: in about 6 months. From the lows it tested in October 2008 it has now scaled back to around 12,000!

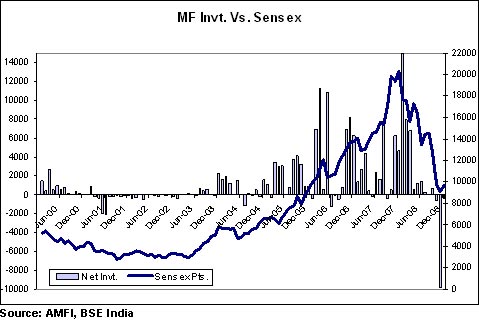

Looking at this spectacular rise of the Sensex my neighbour Ramlal now wants to invest a certain sum of money into equities. Well good start, but wrong timing: the golden rule in equities is 'buy low, sell high', however, the exact opposite is what happens with most investors including Ramlal in this case as the adjacent graph points out.

We see that the maximum inflows into mutual funds happened during the peaks and the turbulent times saw outflows from equity mutual funds. Statistics say that at the top of the market there is a mad rush of investors towards equities. Ramlal was no different.

He did not heed to me when the markets had slumped to 7,700 levels; now that the markets have risen to near-12,000 levels, he wanted to join the party.

Is this a turnaround?

With a positive streak coming in, analysts have started spelling that we are headed for a bull run. However, this may not be true. One needs to evaluate this alongside other macro economic factors. With inflation rate having dipped to 0.18 per cent and on the verge of plunging into deflation, there is nothing to party about.

The political scenario, too, is undergoing transition and over the next few days, there is likely to be uncertainty on who will form the next government. This political development can make the stock markets a tad nervous and they may enter a zone where they will neither rise or fall.

Strategy for starters in equities

I advised Ramlal that since he was not a regular investor in equities, it is not suggested that he try to time the market. Direct equity is avoidable for someone who is apprehensive about equities; use the mutual fund route. You don't need to possess expertise, for the calls are taken by an experienced fund manager, also, they are less volatile/ risky as compared to direct equity.

Use a set of diversified equity funds, balanced funds, which will help design a low to moderate mutual fund portfolio.

It is best to also use the systematic route of investment, which works like a recurring deposit -- a stipulated amount is deducted on a regular basis, which is then invested into equities. This would help average out your cost. You would buy across market cycles as higher units would be bought at lower levels of market and vice versa.

One could always pump in additional money during downtrends. Equities are avenues that should be looked at with a medium term (three to four years) perspective. Although it is unadvisable to put all your money into equities -- a typical case of all eggs into one basket -- hence, a prudent mix of debt and equity mutual fund is pertinent.

Tax implication

Taxes could be a major party pooper for your equity investments. For Ramlal, FDs were ideal, though what went amiss in the whole bargain was that he had to pay taxes on the returns gained since it is treated as 'interest from other income' and is taxed at normal rates (33.99 per cent).

Hence, you would have to evaluate this parameter alongside others such as risk-return profile etc., and accordingly choose investments.

Ramlal has finally decided to move out of his cocoon and decided to start a systematic investment plan into equity mutual funds.

As data shows us, markets tempt us to do the opposite of what we think is a simple rule to make money: buy low, sell high.

Adding some balance to your portfolio is pertinent; being too cautious will hurt in the long term as one ends up with a lower return; at the same time an investor who is too aggressive can face great difficulties in bear markets which in turn discourage investors like Ramlal to approach the stock markets.

A simple asset allocation that one follows in all seasons can do the trick. Disciplined investing is the key to creating wealth.