It is a common thing that investors enter stocks only after the party is over. To tide over this problem, systematic investment plan, SIP, was made popular. But the equity crash of 2008 has shaken investor's confidence like never before. Time and again we have repeated that there is no shortcut to building wealth, except understanding investment basics.

Advice from professionals should only be considered for double-checking what you think is right, just like a second opinion.

At a more basic level should we not be more aware of our own money? Should we not have more control on our finances? If the answer you feel is yes, then obviously the next question you have is 'how do I take control of my finances, if I myself don't understand much about it'?

Obviously, it would have been so much better if we had known when the NAV would rise and fall.

Actually, there were fair indications to understand the rise and fall. But the problem is that investors didn't understand how to interpret these indications. Many times they don't even know what these indications are!

Simple: learn about it. Where is the doubt? If you want your money to grow; if you want to be in better control of your finances, there is only one way: learn how the game is played. Read on to find out what happens if you don't understand the language of money!

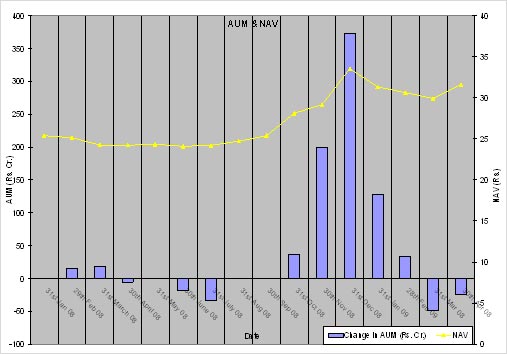

We now have enough data to prove that it is not only in stocks but also debt where investors like to lose money! Take a look at the adjacent chart. This is the data for a gilt (debt) fund, taken from the fact sheet.

Focus on the way the assets under management, AUM, (the blue vertical bars) came down till July 2008 after which there was neither any increase nor any decrease in the AUM for three months; and since October 2008 the AUM shot up each month.

While Rs 37 crore were added in October 2008, November 2008 and December 2008 saw an increase of Rs 200 crore and Rs 375 crore respectively.

What this means is that money went out of the scheme till July 2008 and again entered in big chunks in the last three months of 2008. After this too, money was coming in into this scheme, but at a lesser pace.

So, what's wrong with money coming in and going out of a scheme?

Look at the way the net asset value, NAV, has moved (the yellow line).

From January till July (when money was leaving the scheme) the NAV barely moved. It was Rs 25.38 in January 2008 and was at Rs 24.21 in July 2008. It was from July 2008 the NAV started moving up and reached its peak by December 2008!

What it means is that maximum money entered at the peak, and today all of these investors must be sitting on huge losses as the NAV has been going down since then!

Disclaimer: This article is for information purposes only. Please do not take investment decision based on this article.

The author is a financial trainer for National Institute of Securities Market (Securities and Exchange Board of India's investor awareness arm), Bombay Stock Exchange and leading mutual funds. He runs a website www.moneybee.info and can be reached at ashutosh@moneybee.info.

In the coming few weeks, we will be focusing on these basic things such as cash reserve ratio (CRR), repo rate, reverse repo rate and how we can use all of these to make better investment decisions when investments in a debt mutual fund. Here we go...

RBI uses interest rates to keep economy on track, which means controlling inflation and at the same time ensuring growth. To keep inflation under check, it is important to control money supply. If money in the hands of people increases, people wouldn't mind paying more for things, for which otherwise they would not have paid so much.

Just because they have more money, they will be ready to pay/ spend more. This in turn stokes inflation, which is nothing but general rise in prices. When prices rise, we say inflation is rising.

So to control inflation, it is necessary that money supply in the economy should be controlled. Thus if inflation rises, RBI hikes key interest rates (CRR & repo) so that money supply in the system reduces. When inflation was raging for all of 2008, we saw RBI constantly hiking repo rate & CRR. While we will cover in detail how this affects inflation for the time being it is enough to understand that economic theory suggests that a hike in these rates leads to a fall in inflation.

In 2008 the focus was inflation targeting. We had to bring down inflation. Now things have changed. Inflation has cooled -- not necessarily as the result of RBI policies alone but due to a combination of local/ global factors. This has led to another problem that of lesser growth in the economy.

While high rates help to control inflation, they also stop companies and individuals from borrowing, and this in turn leads to reduced growth, which we are witnessing now.

So now the objective of RBI is to pump prime the economy and get growth back on track. This can be done if companies and consumers borrow from banks and spend. To make loans attractive, it is imperative for the cost of loans to be down. Interest rates are nothing but cost of loans and hence RBI is steadily reducing interest rates by reducing CRR and reverse repo rates. As mentioned earlier, our next article will focus on explaining these terms as well as how prices of bonds rise and fall taking cue from interest rates.

Looking at the chart on the first slide, we can infer that as interest rates came down (or more importantly as market expectations of rate cuts increased), gilt funds' performance started improving.

A conclusion here is that 'as interest rates go up, bond prices go down and bond prices move up as the last two are inversely related'.

Here, before going any further, I would like to focus on the importance of education and self-reliance. Many a times investors say: we don't understand even the basics of investments, forget the finer nuances; that's why we rely on external support of experts.

My point here is that if you do not understand, fair enough, but at least the so-called experts (on whom you rely) should have told you to enter gilt funds in July 2008 because they understand the dynamics of interest rates and rise in bond prices better than you do.

And more importantly, they should have warned you about not entering in December 2008! Reasons can be a plenty, but the bottom line is that nobody can ever (ever) love your money more than you do.

If you are not bothered about your money, do you really think somebody else will be?

And as I said earlier, forget what others say, tell or do if it's your money, you should take charge. Simple. Get up and get going!

The only way to do so is to understand the language of money. It's simple and once you understand it's addictive. Making money is a process not an event and the earlier we start learning the language the better it is for us.

In the next article we will focus on some important terms that we regularly hear and we will slowly build our foundation for understanding and interpreting financial jargon ourselves, including how we had the indications about this debt market rally and the subsequent fall as well. Till then...