| « Back to article | Print this article |

Do you have a tax query?

Have a query regarding tax planning or tax filing? Maybe we can help.

Drop us a line and our expert, Anil Rego of Right Horizons, will answer it.

Got a question for Anil Rego? Please write to us at getahead@rediff.co.in with the subject line as 'Tax query'.

What are the various investments u/s 80C, which will help reduce tax liability?

Section 80C investment up to Rs 1 lakh will qualify as deduction u/s 80C and there are numerous options within this arena. Investments as a genre are divided broadly into equity-oriented and traditional (non-equity) instruments. The various investments allowed herein are:

- PPF (Public Provident Fund)

- NSC (National Savings Certificate)

- FDs (Fixed deposits) (lock-in of more than five years)

- Infrastructure bonds

- Traditional insurance / Traditional pension plans

- Unit linked insurance / UL pension plans

Most of my Section 80C is already covered by means of my PF contribution, for the balance can I invest in PPF?

Investment in PPF needs to be done meticulously. This could not only restrict liquidity but also form a huge component due to the exposure, given the fact that PF is already a mandatory component as part of your salary.

What are tax-saving mutual funds?

The equity linked savings scheme (ELSS) is a scheme wherein the amount invested in the units of the fund is invested in the equity shares of the companies. They invest in equity markets, hence are inherently risky and returns move in tandem with the markets. There is a lock-in of three years, and one has a slew of options to choose from in the market. They are different from your diversified equity mutual funds given the fact these provide tax benefit u/s 80C.

Anil Rego is the founder and CEO of Right Horizons (http://www.righthorizons.com/), an investment advisory and wealth management firm that focuses on providing financial solutions that are specific to customer needs.

Tax benefits of home loan

For self-occupied home interest paid can be claimed as 'Loss from house property' u/s 24 limited to a maximum of Rs 1.5 lakh per annum. Principal paid can be claimed as deduction u/s 80C (alongside other investments).

For property let out on rent interest paid can be claimed as 'Loss from house property' u/s 24. However, there is no limit on the amount that can be claimed.

However, one has to add rental income against interest paid, to arrive at the net benefit you can claim. Keep in mind that there is a deduction of 30 per cent on the rental income you receive towards maintenance. You can also deduct municipal taxes paid.

Principal paid can be claimed as deduction u/s 80C (alongside other investments).

Can someone claim HRA and home loan (self-occupied) benefit simultaneously?

One cannot claim HRA and home loan benefit simultaneously in the same city. If you are in two different cities then you can claim both.

I have two Form 16s and both companies have done TDS. But still I am required to pay taxes although there are no adjustments. What could be the reason?

If you have worked with more than one employer during the same financial year (FY), you are required to collect Form 16 from all the employers. You will be required to consolidate all the sources of income such as bank interest and capital gains while filing your returns. In most such scenarios, you will have a tax payable; this is because you would have got the basic exemption limit and deductions at both places.

Get the full years' income statement from all the employers and do the calculation to pay off taxes before the FY ending to avoid paying interest.

Have a query regarding tax planning or tax filing? Maybe we can help. Drop us a line and our expert, Anil Rego of Right Horizons, will answer it. Got a question for Anil Rego? Please write to us at getahead@rediff.co.in with the subject line as 'Tax query'.

Lost your form 16? No problem

What are the common documents required for tax filing for a salaried employee?

- The common documents applicable are:

- Form 16 (received from employer/s)

- PAN Copy

- Form No. 16A (Where TDS has happened incase of term deposits, consultancy income)

- Summary of all bank statements

- Details of capital gains, rental income (if applicable)

I have lost my form 16, what is the procedure for filing tax now?

Your form 16 will not be required to be attached to your returns. However, some IT Officers do insist on attaching the Form 16 if there is a refund due in you return. Since it is an important document, one can simply request the HR / finance team to issue a duplicate after signing an indemnity bond.

What are the last dates applicable for tax filing?

The last date for filing return of income for the year ended March 31, 2009 is July 31, 2009 and for individuals who are required to get their books of accounts audited under the Income Tax Act, September 30, 2009.

Have a query regarding tax planning or tax filing? Maybe we can help. Drop us a line and our expert, Anil Rego of Right Horizons, will answer it. Got a question for Anil Rego? Please write to us at getahead@rediff.co.in with the subject line as 'Tax query'.

What is Advance Tax?

What is Advance Tax? When is it payable?

Taxpayers are required to pay advance tax on their income, which they expect to earn during the current year. Interest income, capital gains etc., are some of the scenarios where advance tax becomes payable.

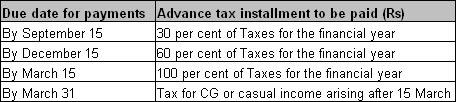

All persons including salaried employees and pensioners in whose case advance tax payable during the financial year is Rs 5,000 or more are required to pay advance tax. The schedule for advance tax installments & due dates is as shown alongside:

Before filing your ITR, an assessee has to pay self-assessment tax. Any tax paid after March 31 of the FY is termed as self-assessment tax.

Have a query regarding tax planning or tax filing? Maybe we can help. Drop us a line and our expert, Anil Rego of Right Horizons, will answer it. Got a question for Anil Rego? Please write to us at getahead@rediff.co.in with the subject line as 'Tax query'.