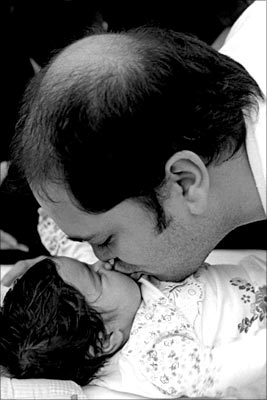

Becoming a parent is a special moment in every individual's life. With the birth of a child a lot of dreams about the child's future are born. A parent's sense of responsibility towards the child is immense. At some stage as your child grows up you start to think about things that you need to plan for your child's future. Higher education and marriage are the most common among them. Giving a good education is the best gift that a parent can give a child.

As we have seen, the cost of education has risen multi-fold in the last few years. Proper planning is needed to meet these needs.

With this focus a lot of parents think of saving and putting aside some money towards the child's future. One of the first options that come to their mind is an insurance policy that has been specially designed for a child. The reason for this is excessive marketing through media and television. Also the friendly insurance advisor generally never misses out suggesting that you should think about investing for your child's future.

This is enough of a reason for a lot of parents to invest money into a child policy without really going into understanding the specifics of how a child insurance plan works. Let us try to understand them.

Disclaimer: The author is not an advocate of child plans as there are many better methods to achieve the objective of securing your child's future. The above article is intended for those parents who have already made up their mind about investing in a child insurance plan.

The article aims to provide insight into some important aspects which most parents miss out when taking up a child insurance plan.

Vetapalem Sridhar is a financial planning specialist. He can be reached at vetapalems@rediffmail.com.

There are two types of children's plans here. The first is the one in which the child's life is insured. Such a plan does not really make sense as the child is not an earning member.

Insurance only provides monetary support. The cover would only give the parents the sum assured in case something happens to the child. No parent would want to benefit from losing their child.

In the second type the life of the Proposer (generally the parent) is assured. Here, in case of death of the parent the future of the child is secured financially. Depending on the type of plan selected, financial support to the child is passed on as stipulated by the plan.

It may vary from giving an immediate support to deferred support on child attaining majority age. When taking up a child plan it is important that the parent understands this aspect clearly.

Disclaimer: The author is not an advocate of child plans as there are many better methods to achieve the objective of securing your child's future. The above article is intended for those parents who have already made up their mind about investing in a child insurance plan.

The article aims to provide insight into some important aspects which most parents miss out when taking up a child insurance plan.

Vetapalem Sridhar is a financial planning specialist. He can be reached at vetapalems@rediffmail.com.

Most decisions regarding the amount to be invested are not planned properly. With the help of a planner/advisor you should be able to estimate how much money is required in future to fulfill the needs of your child.

Once an estimate of fund to be built is known, you can work backwards to find out the amount of money that needs to be invested each year to get there. If the amount invested is less, then there is a risk that you may realise about it quite later in life.

In some such cases it may not be possible to take corrective action.

Generally child plans have a long-term tenure in excess of 10 years. In traditional child plans like money back or endowment policies, the returns tend to be quite less. It is generally close to the rate of inflation. Newer child plans in the form of ULIPs (unit linked insurance plans) are now quite popular in the market.

Such ULIPs provide an option for the parents to build funds for their child through investing money into equities. Equities with such a long tenure provide a great opportunity to grow the money at a much faster rate than the traditional plans.

Hence the amount of money to be invested each year would depend on the type of return potential that the plan offers.

Disclaimer: The author is not an advocate of child plans as there are many better methods to achieve the objective of securing your child's future. The above article is intended for those parents who have already made up their mind about investing in a child insurance plan.

The article aims to provide insight into some important aspects which most parents miss out when taking up a child insurance plan.

Vetapalem Sridhar is a financial planning specialist. He can be reached at vetapalems@rediffmail.com.

There is one important issue here that needs careful attention. In certain child plans on maturity the maturity benefit, that is, the final fund built is transferred to the child's bank when he/she becomes a major on reaching the age of 18 years. Receiving a lump sum amount at such a young age is fraught with risk. The child would most probably not have earned any money and hence may not be mature enough to use the money responsibly. Also 10 to 15 years down the line we do not know how the younger generation would be.

Freedom without responsibility can be a recipe for disaster. It may not be such a wise idea for a child to receive huge money into her/his bank at such a young age.

There are other child plans in which the maturity benefits or any intermediate benefit is paid to the Proposer (parent) or to an Appointee (guardian) in case of death of the Proposer. In such a plan we can be assured that money will rightly be used for its intended purpose (like education expenses, etc).

There are certain other plans in which the Proposer can assign the policy to the child, when the child becomes a major. Here again it may be a wiser move to NOT assign the policy to the child. This will ensure that irrespective of when the policy would mature, the control of money will always remain with the Proposer (Parent).

Disclaimer: The author is not an advocate of child plans as there are many better methods to achieve the objective of securing your child's future. The above article is intended for those parents who have already made up their mind about investing in a child insurance plan.

The article aims to provide insight into some important aspects which most parents miss out when taking up a child insurance plan.

Vetapalem Sridhar is a financial planning specialist. He can be reached at vetapalems@rediffmail.com.