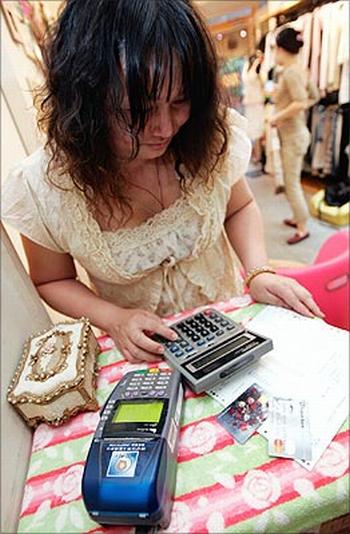

It is festive season once again and a lot of you might be swiping your recently acquired credit card for the first time. You enter an electronic store and just couldn't resist your itching fingers from swiping your credit card. Before you know you have used your credit card to finance the purchase of your favourite gadget/micro wave ovens/LCD/refrigerator/laptop or whatever else you want to.

You feel right on top of the world with your latest acquisitions and flaunt it in front of all and sundry. And then you get your credit card billing statement and you come down to earth.

How on earth could I have spent so much, you wonder. But the statement is in your hand and you have to deal with it. Here's what you must know about your credit card billing statement to make your credit card work for you.

1. What is a billing statement?

A billing statement refers to the statement of purchases by using the credit card at several establishments. It is usually issued once a month. You should verify the billing statement against charge slips and any error and/or inconsistency should be reported to the institution immediately.

You have two choices for making credit card payments. You may clear your dues as soon as you receive your billing statement, in one shot.

Or you may choose to pay the minimum monthly installment mentioned on the statement (which is usually between 5-10 per cent of the total amount outstanding as on the date of the statement) and avail of revolving credit on the balance.

In other words, your credit amount rolls over to the next month and so on.

In a majority of cases, interest will be calculated on the average daily balance method on the unpaid balance, plus amounts incurred for new purchases. Average daily balance depends usually on the amount outstanding and the number of days it is outstanding for.

3. What is the minimum amount payable every month for credit cards?

The minimum amount would differ for various credit card issuing banks and ranges from 5 per cent to 20 per cent of the total amount billed.

4. Is there a fixed billing dates cycle?

Yes, every card follows a monthly date of billing and this date will be notified to you when you receive the first billing statement. This statement would reflect all the purchases made if the bank has received the details on or before the date of billing.

Yes. A duplicate copy can be obtained by paying a service charge. This typically ranges from Rs 100 to Rs 300. The duplicate statement would take around 1 to 2 weeks.

6. What happens if I am unable to pay back my monthly amounts?

You will receive telephone call reminding you to pay the outstanding amount. If you ignore this, recovery agents representing the card issuing bank or company will visit your house at odd hours causing you and your family considerable embarrassment.

7. What do I do if I disagree with a charge on my credit card?

If you believe that there was an error on your credit bill, please notify the credit card company giving full details of your name, account number, type of card and the amount of the error. Never make a payment of the disputed amount till the corrections are made in the subsequent billing statement.

Different credit card companies have different monthly billing cycles. Therefore, if you have access to different credit cards, you are in a position to make full use of the interest-free grace period provided by the respective card companies.

9. What is free period or grace period of credit?

The card issuing institution allows you some time before you pay them back. You also have the option to pay a part of the total amount spent and carry forward the balance amount, on which you pay interest. The period from the date of purchase to the day you must settle the bill is known as the grace period.

10. Are my credit card transactions and credit card bills available online?

Yes. Some banks offer this facility of permitting you to access your transactions and statements online. However, this is an upcoming service and it will be some time before all credit card companies provide this facility.