| « Back to article | Print this article |

7 steps that will benefit mutual fund investors

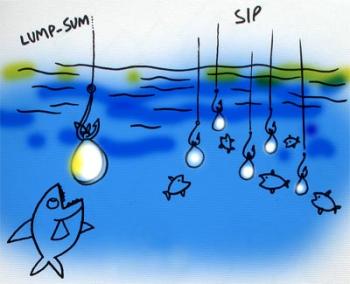

The stock market regulator in India the Securities and Exchange Board of India (SEBI) has brought in sweeping changes for the mutual fund industry. It's impact will be felt on the investor in more ways than one. And here are 7 steps that SEBI has taken for the benefit of common investots in mutual funds.

1. For new fund offers (NFOs)

They will only be open for 15 days (Equity-linked savings scheme funds though will continue to stay open for up to 90 days). It will save investors from a prolonged NFO period and being harangued by advisors and advertisements. The motivation behind the rule seems to be simple -- if you can invest anytime, why keep NFO period long?

2. NFOs can only be invested at the close of the NFO period

Earlier, mutual funds would keep an NFO open for 30 days, and the minute they received their first cheque, the money would be directly invested in the market; creating a skewed accounting for those who entered later since they get a fixed NFO price.

The market regulator has corrected this by extending application supported by blocked amount (ASBA) to mutual funds. This will become effective starting July 1st this year.

By the ASBA process one can continue to earn interest in the bank account until the NFO closes (remember there is usually no rejection or 'oversubscription' in a mutual fund NFO) which means that the cheque goes for clearing after the NFO has closed irrespective of when it was sent. The fund manager will be able to invest once the NFO closes.

3. Dividends can now only be paid out of actually realised gains

Impact: It will reduce both the quantum of dividends announced, and the measures used by MFs to garner investor money using dividend as a carrot to entice new investors.

4. Equity mutual funds have been asked to play a more active role in corporate governance of the companies they invest in.

Impact: This will help mutual funds become more active and not just that, they must reveal, in their annual reports from next year, what they did in each 'vote'. SEBI has now made it mandatory for funds to disclose whether they voted for or against moves (suggested by companies in which they have invested) such as mergers, demergers, corporate governance issues, appointment and removal of directors. MFs have to disclose it on their website as well as annual reports.

5. Equity funds were allowed to charge 1 per cent more as management fees if the funds were 'no-load'; but since SEBI has banned entry loads, this extra 1 per cent has also been removed.

6. Regarding the fund-of-fund (FOF)

The market regulator has stated that information documents that asset management companies (AMCs) have been entering into revenue sharing arrangements with offshore funds in respect of investments made on behalf of fund of fund schemes create conflict of interest. Henceforth, AMCs shall not enter into any revenue sharing arrangement with the underlying funds in any manner and shall not receive any revenue by whatever means/head from the underlying fund.

7. SEBI has also asked mutual funds to reveal all commission paid to it's sponsor or associate companies, employees and their relatives.

These guidelines set by SEBI will lead to greater transparency for the common investor. SEBI formulates policies and regulates the mutual funds to protect the interest of the investors. With these guidelines falling in place it would create better trust and transparency and an investable environment that would attract investors with greater faith and confidence. A welcome and refreshing move!