Come February and March and salaried employees look for guidance for investing in tax-saving schemes. And equity linked saving scheme (ELSS) rank as one of the popular investment destination for them.

In a question and answer session with www.personalfinancewindow.com, Ramesh Kabra, head, product development at Taurus Mutual Fund addressed several issues ranging from investment opportunities to save taxes to the benefits of investing in ELSS funds.

How can an investor buy ELSS from mutual funds? How is the return in the ELSS compared to other schemes like PPF and NSC?

ELSSs could be open-ended or close-ended in nature. Majority of ELSS schemes are open-ended. This means they are open for subscription on all business days. As the name suggests, the scheme primarily invests in equity market by buying equity stocks of companies listed on the stock exchanges.

The units of the scheme are offered at the NAV (net asset value). The NAV is announced for all business days and keeps changing primarily depending upon the movement in the prices of stocks held in the portfolio of the scheme.

Equity as an asset class has given a higher return over the long term. ELSS has the potential to give substantially higher returns as compared to that from PPF or NSC over the long-term. The returns from PPF or NSC are in the range of 8 per cent and at times may not beat inflation.

Returns from ELSS could fluctuate depending upon the performance of the equity market and also the stock selection criteria of the particular fund manager. Returns from ELSS could even be negative in the short to medium term. As on 31st December, 2009, the average compounded annualised growth rate (CAGR) over 3 and 5 years period for the ELSS category of funds was 8.2 per cent and 20.1 per cent respectively.

ELSS also scores over other tax-saving schemes since it offers tax-free return (long-term capital gains and dividends are totally tax-free as per the current tax structure). Only PPF offers tax-free return but it has a maturity period of 15 years.

Click NEXT to read investment options to save taxes.

What are the investment schemes where investors can save taxes?

An investor can save taxes by investing under the following sections of the Income Tax Act, 1961:

Under Section 80C tax deduction an individual could invest up to a maximum limit of Rs 1 lakh in one or more of the following options put together:

(a) PPF (Public Provident Fund): Under this scheme the maximum investment permissible in a financial year is Rs 70,000

(b) EPF (Employees Provident Fund)

(c) Life Insurance Premium

(d) Pension Plan premium (under Sec 80CCC)

(e) ULIP

(f) ELSS (Equity linked saving scheme)

(g) NSC (National Savings Certificate)

(h) 5-year bank fixed deposit

(i) 5-year post office time deposit

(j) Infrastructure bonds / NABARD rural bonds

(k) NPS (New Pension Scheme) under Sec 80CCD

Click NEXT to read the criteria for choosing ELSS schemes.

What is the lock-in period for ELSS?

There is a lock-in period of 3 years from the date of allotment. This means that after investing in the scheme, the investor cannot redeem or withdraw the invested amount for a period of 3 years.

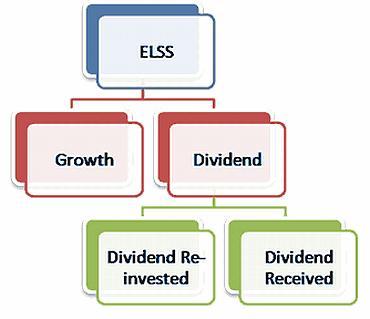

But, this is one of the major advantages of ELSS since it has the lowest lock-in period as compared to the other tax-saving instruments like PPF, NSC and bank fixed deposits etc. Investors who want periodic dividends can consider the dividend payout option under the ELSS category, wherein the dividends received are also tax free. In fact, this is the only investment option under Section 80C which provides interim cash flow during the lock-in period.

What should be the criteria for choosing ELSSs offered by the different MFs?

The investor should apply the following criteria while selecting an ELSS for an investment:

(i) The track record of the fund at least over the last 2 to 3 years. One should not attach too much importance to the recent 1-month or 3-month performance.

(ii) The dividend history of the fund.

(iii) It is not necessary that the investor should select an ELSS based on its large size.

(iv) The discerning investor could also look at the portfolio of the scheme to ensure that it is well-diversified across market caps.

(v) If the investment amount is more than Rs 20,000, then probably the investor could select two ELSS funds instead of one. It could be a mix of an established name and an upcoming fund.

Click NEXT to read the how much should you invest in ELSS schemes.

How to start an ELSS account?

The investor can use the services of a mutual fund distributor or directly approach the fund house for making investment in the ELSS. The distributor would provide the application form or one could download it from the website of the fund house. The investment could be made in a single name or one could add second and/or third applicant.

For investing in ELSS or for that matter in any scheme of a mutual fund the investor should have a PAN card. If he or she wishes to invest Rs 50,000 or more then they should be Know Your Client (KYC) compliant. These criteria would also be applicable for all the joint applicants. The duly filled-in application form along with the cheque and other documents need to be submitted at the Investor Service Centre of the fund house on any business day before the cut-off time of 3 pm to get the units allotted at the NAV of that day.

The fund house normally sends the account statement within 3 to 4 working days. If the investor provides the e-mail ID in the application form, the account statement could be sent by e-mail. Many fund houses also offer the facility of investing in the fund online through their web sites. Recently, the regulator has also allowed the registered stock brokers to offer the facility of investing in mutual fund schemes to their clients through the stock exchange mechanism.

How much should one invest in ELSS?

The amount that needs to be invested in ELSS would depend on the other investments already committed towards PPF, EPF, insurance etc. A young investor could use the entire limit of Rs 1 lakh for investing in ELSS if s/he is not investing in other tax-saving instruments under Section 80C whereas an aged investor could decide on a mix of three or four investment options. But, an investor should not ignore the ELSS option because this is the only option which has the potential of delivering higher returns.

Click NEXT to read the other benefits of investing in ELSS schemes.

Which fund houses offer ELSS? Can an investor combine it with SIP?

Most of the fund houses offer ELSS. Yes, ELSS funds offer the facility of SIP. Ideally, a salaried investor should start her/his SIP in an ELSS fund in the month of April itself so that s/he gets the benefit of rupee cost averaging and s/he need not have to worry about the cash flow problem at the end of the financial year.

What are the other benefits of ELSS fund?

An ELSS fund should definitely figure in the tax-saving list of every tax payer. Tax-saving is not only about investing for saving taxes but it should also have the potential for wealth creation in the long run. Among all the tax-saving instruments only ELSS offers this potential for wealth creation.

Even though ELSS fund has lock-in period of 3 years it does not mean that the investor should necessarily redeem her/his holdings after completion of 3 years. It could happen that at that given point of time the equity markets may be down and consequently the NAV of the ELSS fund could also be low. One could allow it to remain in the fund for a much longer period. One should think of redeeming only if s/he are genuinely in need of funds or the ELSS, where the investor has invested, has underperformed the peer group.