Mutual funds need no introduction. They are one of the most popular investment vehicles in the country today. Mutual funds allow a group of investors to pool their money together and taste a broader range of stocks or bonds than they could if they were trying them on their own.

Some of the many benefits of investing in mutual funds are:

1. Easy to buy and sell

2. Investments can be made in lump sum or periodic payments (easy on the pocket)

3. Mutual fund industry in India is very well regulated and transparent

4. Professional management saves time and costs.

5. Diversification helps to protect from downside risk

6. Rupee cost averaging helps profit from small regular investments

There are many categories of mutual fund schemes available today and in each category there are 100s of mutual funds present akin to stars in a milky way.

But depending upon the category of mutual fund scheme you invest in, the earnings from such investments can be in the form of regular income (dividend payouts) and/or capital appreciation. The taxation differs for different categories of mutual fund schemes.

Click NEXT to find out the best MFs to invest in 2010.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

The characteristics of growth oriented mutual fund categories and the top funds under each category based on last 5 years' performance are reviewed below:

Equity diversified MFs

Equity diversified funds invest primarily in stocks across sectors and industries. Hence it minimises the risk of exposure to a single company or sector. These funds can be large cap, mid cap or small cap oriented depending on the fund manager's style and investment objective.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

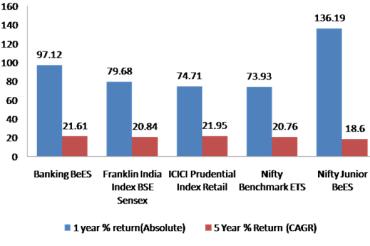

Exchange traded funds (ETFs) are funds that track stock market indexes.

The main difference between ETFs and other types of index funds is that ETFs don't try to outperform their corresponding index, but simply replicate its performance.

ETFs are highly valued for their low cost in terms of expense ratios. Since they don't have managers actively buying and selling investments within the funds, the costs to run them are significantly lower.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

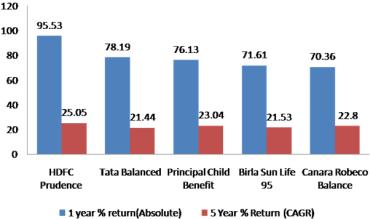

Balanced funds (also called hybrid funds) provide investors with a single mutual fund that combines both growth (equity) and income (debt), by investing in both stocks and bonds.

Such diversification ensures that the funds will manage downside of the stock market fluctuations without too much of a loss; the flip side is that balanced funds will usually give returns less than an all-equity fund during a bull market.

Click NEXT to read about four ratios you must before investing in MFs.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

A good track record is no guarantee for future performance. You should also look at some quantitative measures to evaluate which fund is good for you.

1. Expense ratio: Denotes the annual expenses of the funds, including the management fee, and administrative cost. Lower expense ratio is better.

2. Sharpe ratio: An indicator of whether an investment's return is due to smart investing decisions or a result of excess risk. Higher Sharpe Ratio is better.

3. Alpha ratio: Measures risk relative to the market or benchmark index. For investors, the more positive an alpha is, the better it is.

4. R-squared: Measures the percentage of an investment's movement that are attributable to movements in its benchmark index. A mutual fund should have a balance in R-square and ideally it should not be more than 90 and less than 80.

You should do sufficient analysis before taking investment decisions. It should be guided by your overall financial situation, goals and risk profile. A Financial Plan is recommended before making investment decisions. SIP (Systematic Investment Plan) for a long time horizon is the most recommended way to invest in equity funds. You should avoid lump sum investment especially when the market is on a high.

www.investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.