| « Back to article | Print this article |

Understanding taxes: Your options under Section 80C

As the end of financial year approaches investors are suddenly woken up to the existence of the Income Tax department. If you haven't done the tax planning in advance then this is the time to carefully select the investment products under Section 80C.

If you think you have already missed the bus this year (March 31 is round the corner) then there's always the next year. Prepare yourself for optimising your tax benefits next year right now. A wise investment will not only lessen your tax burden but also give some good returns.

What is Section 80C?

Under section 80C of the Income Tax Act, certain investments are deductible (up to a maximum of Rs 1 lakh) from your gross total income. This tax exemption is available across individual tax slabs. If you earn Rs 4 lakh per annum and make investments of Rs 1 lakh in 80C instruments then the taxable amount will be Rs 3 lakh.

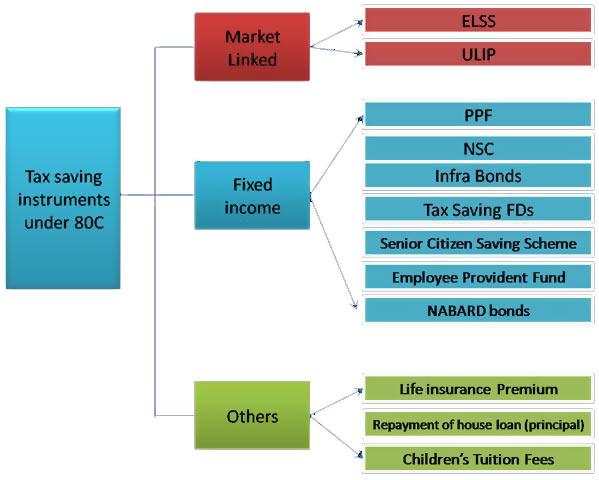

It is not at all complicated. Click NEXT to see a simplified chart.

Investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.

Never make investments just for saving tax

Fixed income instruments, which offer fixed returns, are suitable for risk averse investors who want to protect their investment from the uncertainties of the market. All these instruments are backed by the Government and hence they are risk free. But the returns may just beat the inflation and you should not expect any meaningful appreciation in investments. Per annum returns will vary from 6 per cent to 10 per cent depending upon the instrument you choose.

Market linked: Market linked products are ELSS (equity linked saving scheme) and ULIPs (unit linked insurance plan). These instruments invest the money in equities (except some debt based ULIPs) and hence there is an inherent market risk. However it has been seen that over a long period return from equities beat inflation by a comfortable margin and create wealth for the investor.

ELSS is similar to mutual fund except that it has a lock in period of 3 years. The money is invested into diversified stocks by a fund manager/AMC. On the other hand ULIPs are a form of life insurance where a part of the premia is invested into equity or debt market (or combination of two). ULIPs usually have longer lock-in periods.

ELSS: ELSS has some advantages over other investments and people with moderate to high risk appetite should consider them seriously. Some key features of ELSS are:

Lock-in period of 3 years

- SIP (Systematic Investment Planning) available

- Diversified equity investments

- Different funds for different risk profiles in terms of exposure to large cap, mid cap and small cap

- Dividend paid out is tax exempt

- At maturity the proceeds are exempt from long term capital gains tax

Here is the list of best tax saving mutual funds to invest this financial year.

To sum up

Section 80C benefit has been provided to encourage long term savings and investments. You should choose a combination of fixed income and market linked investments depending on your age and risk profile. For example if you are in your 20s, give a higher allocation to ELSS whereas if you are nearing retirement, concentrate more on fixed income investments.

But remember that investment is to be done keeping your overall financial situation and future goals. Tax advantage is just an add-on benefit. Never make investments just for saving tax.

Investmentyogi.com is a one-stop personal finance website which helps in managing finances, investments and taxes through services like financial planning, online tax filing, budgeting and 'Ask the Expert'.