| « Back to article | Print this article |

Quiz: How well do you know your taxes?

Think that you are a tax expert? Take this simple tax quiz and find out.

If you get less than 4 right answers then consider your tax quotient as average.

If you get between 5 to 7 right answers then consider your tax quotient as good.

If you get between 8 to 10 right answers then consider your tax quotient as excellent.

1. When is the Direct Tax Code being implemented?

a) April 1, 2011

b) April 1, 2012

c) It is already implemented

The correct answer is April 1, 2012

As per the new Direct Tax Bill 2010, DTC will come into effect on April 1, 2012.

As per the new Direct Tax Bill 2010, DTC will come into effect on April 1, 2012.

Quiz: How well do you know your tax

2. The Rs 20,000 additional investment in Infrastructure bond comes under which section?

a) Section 80C

b) Section 80D

c) Section 80CCF

The correct answer is Section 80CCF

The finance minister provided additional Rs 20,000 worth of tax-exempt investment over and above Rs 1,00,000 under section 80C. It comes under section 80CCF.

The finance minister provided additional Rs 20,000 worth of tax-exempt investment over and above Rs 1,00,000 under section 80C. It comes under section 80CCF.

Quiz: How well do you know your tax

3. What is the difference between AY (Assessment Year) and FY (Financial Year)?

a) They are same

b) AY is one year before FY

c) AY is one year ahead of FY

The correct answer is AY is one year ahead of FY

AY is the year when the tax return is submitted and it is after the financial year is over. Hence it is the first year ahead of financial year.

AY is the year when the tax return is submitted and it is after the financial year is over. Hence it is the first year ahead of financial year.

Quiz: How well do you know your tax

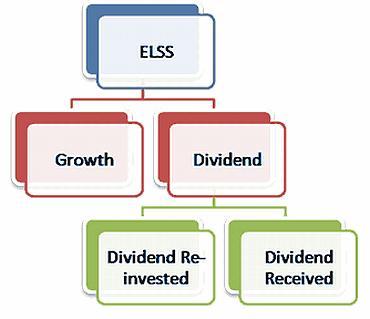

4. What is meant by ELSS?

a) Equity Linked Saving Scheme

b) Equity Like Saving Service

c) Enterprise Linked Savings and Scheme

The correct answer is Equity Linked Saving Scheme

ELSS are those equity mutual funds that get tax exemption under section 80C.

ELSS are those equity mutual funds that get tax exemption under section 80C.

Quiz: How well do you know your tax

5. If you are an individual having income from salary, house property and capital gains, which ITR form should you use?

a) ITR-1

b) ITR-2

c) ITR-4

The correct answer is ITR-2

Such an individual will file ITR-2. ITR-1 is filled only by salaried individuals.

Such an individual will file ITR-2. ITR-1 is filled only by salaried individuals.

Quiz: How well do you know your tax

6. What do you understand by section 80D?

a) Exemption for charity

b) Exemption for education loan

c) Exemption for medical insurance premium

The correct answer is Exemption for medical insurance premium

Section 80D bestows tax exemption up to Rs 15,000 (and additional 15,000 for your parents) for premiums on medical insurance.

Section 80D bestows tax exemption up to Rs 15,000 (and additional 15,000 for your parents) for premiums on medical insurance.

Quiz: How well do you know your tax

7. What is the due date for filing income tax return for individuals?

a) March 31 of every year

b) December 31 of every year

c) July 31 of every year

The correct answer is July 31 of every year

The due date for filing tax return is July 31st of every year. This year the due date was extended up to August 4 by the Central Board of Direct taxes.

The due date for filing tax return is July 31st of every year. This year the due date was extended up to Aug 4thby Central Board of Direct taxes.

Quiz: How well do you know your tax

8. What is the tax exemption limit for gifts received from non-relatives?

a) Rs 20,000

b) Rs 50,000

c) Rs 100,000

The correct answer is Rs 50,000

As per the income tax guidelines any gift (in cash or kind) received from a non-relative should be added to your income and taxed.

As per the income tax guidelines any gift (in cash or kind) received from a non-relative should be added to your income and taxed.

Quiz: How well do you know your taxes

9. How much can you invest per year in PPF (Public Provident Fund) account?

a) Rs 70,000

b) Rs 20,000

c) Rs 50,000

The correct answer is Rs 70,000

PPF is an investment for retirement purpose and IT department allows exemption up to Rs 70,000 per year under section 80C. It will remain exempt even after DTC comes in.

PPF is an investment for retirement purpose and IT department allows exemption up to Rs 70,000 per year under section 80C. It will remain exempt even after DTC comes in.

Quiz: How well do you know your taxes

10. What is Form 26AS?

a) A statement of TDS (Tax deducted at source) and TCS (Tax collected at source)

b) A statement of tax penalty

c) Application form for new PAN card

The correct answer is A statement of TDS (Tax deducted at source) and TCS (Tax collected at source)

Form 26AS is a statement of tax deducted at source for an assessee. It also tells you tax collected at source.

Form 26AS is a statement of tax deducted at source for an assessee. It also tells you tax collected at source.