| « Back to article | Print this article |

Business of fashion: Here's what happens at Lakme Fashion Week

Buyers tell Abhishek Mande how they decide what is 'too creative' to be saleable and the issues they face with designers.

Currently in its eleventh year, the Lakme Fashion Week is perhaps one of the most written about events in the Mumbai calendar.

With a heavy media presence, the glamour extravaganza sees some very prominent names from showbiz showing up in their best. Far away from all this glitz and glamour though in a tent that is called 'The Source' business is conducted.

Buyers from across the country comb through 'The Source' and spend hours pouring over the material, colour and the detailing of each piece of cloth.

Certainly there is some amount of haggling that happens -- designers wanting the storeowners to buy off their clothes rather than take it as part of a consignment and pay them off as and when the designs go off the rack at their glitzy showrooms.

At its very essence any fashion week is like a trade exhibition. Sellers put up their wares and wholesalers buy it in bulk.

While traditionally Delhi and Mumbai have been the biggest markets for designer clothes, the scene is slowly but surely shifting towards the tier two cities.

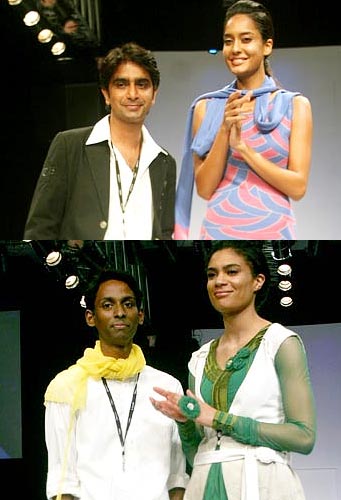

Young designer Masaba Gupta recently pointed out that towns in Gujarat are waking up to the reality of designer labels -- even those as eclectic as hers. While Gujarat might have a substantial migrant NRI population, the rise in the Indian middle class' purchase power has been the cause elsewhere.

ALSO READ: An encounter with Masaba Gupta

Inspiring buyer confidence is the real challenge for young designers

Unsurprisingly the rush to be part of Lakme Fashion Week is growing.

When Lakme Fashion Week threw its doors open to aspiring applicants for its Winter/Festive 2010 season, a record number of 172 designers turned up to compete in the GenNext category and 92 others vied for a spot in the Emerging Designers category.

From among these six were selected as GenNext and seven as Emerging Designers.

But being a part of this extravaganza comes at a cost. A young designer, who did not wish to be named and who had participated in the LFW last season, told us it cost him around Rs 300,000 so he could get a spot in the line-up.

It is understandable that designers like this 20-something are keen that the buyers place a straight order for a specific number of designs and pay upfront.

However being new in the business comes with its flipside. Inspiring buyer confidence isn't as simple as it might seem.

'Sometimes designers do not send out their best pieces'

Most of them -- including the biggest chains of retail stores -- prefer dealing in consignment stock. This means the stores will display their designs, but pay the designers only for the pieces sold.

Often the unsold stock returns to the designers who then have to figure out what to do with all the unused goods.

This holds true for even for some of the bigger designers who retail through different stores in the country.

Aparna Badlani, who runs Zoya, a store in Mumbai, says that 95 per cent of the stock in her store is consignment.

"We are an eclectic store that stocks experimental designs," she says. "Since we always try out new designs and designers it doesn't work for us if we buy stock from a designer that doesn't sell. It becomes important for us to keep shuffling our stock."

On the other hand Sushil Jhaveri, the owner of the multi-designer Fuel fashion store chain, suggests a way out. "At Fuel," he says, "we've noticed that when we ask for consignment, designers do not necessarily send out their best pieces. So we have separate understanding with different designers. Some work on a consignment basis, others on outright purchase. But to many of our designers, we commit a minimum sale. This ensures they send us their best designs -- some of which are exclusive to Fuel -- and we guarantee them fixed revenue."

Fuel is a commercial outlet that may not necessarily entertain eclectic designs, the kind that Zoya stocks. This means working with the designers and ensuring that their clothes are not 'too creative' for Jhaveri's customers.

'Indian wear contributes to 70 per cent of the sales'

Fuel's brand and marketing team works in close coordination with the designers and suggests changes that will make the clothes 'saleable' rather than exotic designs that inspire awe but generate no revenue.

He also draws attention to the fact that because of its weather, India doesn't have distinct seasons the way Western markets do and says it makes more business sense to focus on creating designs that suit Indian sensibilities.

"Indian wear contributes to 70 per cent of the sales in our store," he says, adding that it is important to understand and focus on the local market first rather than looking outside India.

The new format of Lakme Fashion Week -- that unlike the West showcases designs for summer/resort, just before the summer begins and the winter/festive line a couple of months before the country goes into a celebration mode -- reduces the recovery time for designers. This also means lesser lead times and greater challenges to meet the demands.

This is where Caroline Young, an independent buying agent who sources designs for exclusive clients in the West, voices her grouse with Indian designers, especially the younger ones.

"Very often," she says, "we come across designers who simply do not stick to their commitment of delivering on a particular date. I understand with the younger designers, infrastructure and finances can be an issue. But I see that a lot of designers from the younger crop insisting on over committing and under delivering."

Jhaveri faces the same issue -- even from some established names. "The later I receive my stock, the more difficult it becomes for me to get it off the shelves."

What young designers should remember

Sujal Shah, Head of Fashion for IMG India, often finds himself being torn between designers and buyers. He confesses that it leaves him in a not so pleasant position when people like Young, Jhaveri and Badlani call him up complaining of un-met deadlines.

"It simply isn't done," he says addressing the new crop of designers listening in intently during a workshop he is addressing at the Grand Hyatt Hotel in Mumbai.

Some of the designers have been fortunate to be selected for the Lakme Fashion Week. Others are here to network and listen in to what industry veterans have to say.

Shah spells out six tips for young designers that he hopes they will live by through their careers:

- Pay attention to detail. Your buyers are sitting in the front row and can see every single crease and lose stitch.

- Delays are a no-no. When you commit to a date, stick by it.

- Be open to changing designs according to the buyer's requirements. They know the market better than you.

- If you are hoping to design for the international market, you better know the sizing -- American size four is different than European size four.

- Know your limits. If you know you can't meet a demand, say it at the outset. It gives the buyers an option of deciding whether they want to buy your clothes or not.

- Quality control is a must. Buyers will not come back if the quality of your clothes is poor.