Photographs: Rediff Archives Salil Dhawan, Investment-Mantra.in

The answer, obviously, may vary from individual to individual, depending upon risk appetite and investment goal. More importantly, however, if one acts in haste, one may also have to repent at leisure. Who knows? So, what should one do?

It is certainly very difficult to find out a definite answer and a clear-cut strategy, for sure. Still we can take some lessons from past mistakes and use our common sense to find the way out.

Here are some tips which may help one stay clear of the mess and chart out some winning strategies in these times of crisis and world-wide panic:

Click NEXT for more

Courtesy: Investment-mantra.in

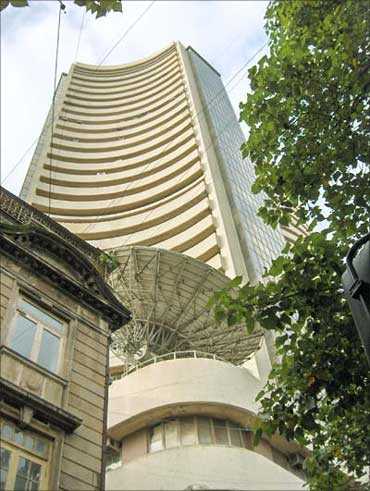

Tips to invest in stocks post US downgrade

Many investors have been waiting on the sidelines for a correction to happen so that they can time their entry into the market. That time has come now and you should use this as an opportunity to take an exposure in equity markets if you have a relatively long-term investment horizon.

Investing in blue chips such as ICICI Bank, TCS which have corrected significantly can be looked forward as long-term investment opportunities.

Don't buy stocks just because they are cheap

Don't buy just any stock which is available cheap, but only the stocks of those companies whose fundamentals are strong have good management and growth potential.

Click NEXT for more

Tips to invest in stocks post US downgrade

Volatility in stock markets is extremely normal. On the other hand, lack of volatility is abnormal. If your financial goal is a few years away, then there is no reason for you to panic.

In fact, you should behave rationally and shift more money into equity from your debt portfolio. In case your goal is very near, then you should not have been in the equity market in the first place. Evaluate your risk profile before making an investment decision.

Don't allow fear or greed overpower you

Many investors have been losing money in stock markets due to their inability to control fear and greed. In a bull market, for instance, the lure of quick wealth is difficult to resist. Greed augments when investors hear stories of fabulous returns being made in the stock market in a short period of time.

This leads them to speculate, buy shares of unknown companies and create heavy positions in the futures segment without really understanding the risks involved. Instead of creating wealth, such investors thus burn their fingers very badly the moment the sentiment in the market reverses.

In a bear market, on the other hand, investors panic and sell their shares at rock bottom prices -- thus losing money again. It is clear, thus, that don't let your investment decisions be guided by either fear or greed.

Tips to invest in stocks post US downgrade

In the long run the Indian stock markets have given a return of around 18% per annum and the mutual fund equity schemes have given a return of around 20-22% per annum over the last 15 years. During this time period we have seen two market crashes in 2000 and 2008. Investors who rode through this period without reacting to them are the ones who did well.

In perspective a 20% return which is tax free through an investment which is very liquid and can be sold any day is a very strong return. Moreover, investing at near market bottoms for the year or at levels which are 15-20% away from the top of the markets typically will increase these returns by 2-3% on an average over the long run. As such this is the time to increase allocation to equities rather than reduce.

The interest rates in India have probably peaked out and rates will come down by at least 1.5 to 2 per cent over the next one year. This will also be positive for equities.

Tips to invest in stocks post US downgrade

Reduce your average cost of holding

If you are already holding investments in equity schemes, then every dip provides you with an opportunity to reduce your average cost of holding by investing more amounts in equity schemes. You can do this in a staggered manner.Don't invest in most popular investments in a big way

Today the most popular investments are gold and fixed deposits/FMPs.

This is not to say that investors should not allocate to these asset classes, but these assets are highly overbought and popular at this stage and typically when an asset class is so overbought, then typically they are unlikely to give very good returns over the forthcoming period.

Since these assets are easy to sell to customers by showing the returns they have given or the potential returns from the investment, these are the investments that relationship managers/ wealth mangers will be pushing to investors.

However, investors need to focus on proper asset allocation and look at long-term return potential and long-term historic returns before allocating.

Don't stop your systematic investment plan (SIP)

As a knee jerk reaction, many investors make a hasty and wrong decision of foreclosing their ongoing SIPs.

In fact, the basic principle of investing in a SIP is based upon this fact that in times when the markets are low, your investment in SIP fetches you more units and thereby your overall returns at maturity improve considerably.

Tips to invest in stocks post US downgrade

Typically market falls due to panic reactions in the markets present strong investment opportunities as the fall in the markets due to these kinds of events are more due to the lack of knowledge of what the event entails rather than the actual impact of the event.

In the short run, the short-term traders could dominate and we can see a sell off in equities but it may not sustain. Looking at the way the equity markets have behaved over the last couple of weeks that this move was anticipated, if not seen coming.

Most European markets have corrected by 20% in a very short period of time, the US markets by nearly 12-13% and most emerging markets by over 10%. Normally the markets play the sell on rumour buy on news very well.

Equities are very cheap relative to growth prospects at this point of time and could become cheaper if the markets sell off due to this news.

The markets after panic falls may give returns of upwards of 15% over the next few months. As such investors should not be too much bothered about the short term.

History repeats itself

Please remember that the markets have corrected several times in the past and have also bounced back with a vengeance. After rising to 21,000 levels in January 2008, the markets fell to 8,000 in the year 2009 and then bounced back to 18,000 in the year 2010.

Comment

article