Salil Dhawan, Investment-Mantra.in

A comprehensive look into what this scheme is all about and why as an investor one should not go for this scheme.

Recently Reliance Mutual Fund has come up with a new offering 'Reliance SIP Insure' under which they provide an add on feature of life insurance cover under group term insurance to individual investors opting for SIP in the designated schemes.

Let us first try to understand various aspects of the offering:

What is Reliance SIP + Insure?

Reliance SIP Insure provides free life insurance cover to investors at no extra cost. In the unfortunate event of the demise of an investor during the tenure of the SIP, the insurance cover will take care of the unpaid installments.

Thus, the nominee would be able to continue the scheme without having to make any further contribution. Investor's long term financial planning and objective of investing through SIP could still be fulfilled as per the targeted time horizon, even if he/she dies prematurely. (Nominee would mean designated nominee on the application form, in case of single holding & second or joint holder in case of joint holding).

Click NEXT for more

Courtesy: Investment-Mantra.in

Reliance SIP + Insure: Should you invest?

The benefits SIP Insure provides according to Reliance Mutual Fund

The benefit of long term equity investment:

- Equities provide relatively better returns among all asset classes over a longer period of time

The benefit of systematic investment plan:

Inculcates savings habit

Rupee cost averaging; eliminates the need to time the market

Free life insurance cover:

- Helps to complete the planned investments

- Maturity proceeds at NAV based prices

Flexibility:

- Wide choice of eligible schemes

Convenience:

- Auto debit from 14 banks

- ECS facility across 87 locations

Designated schemes in which Reliance SIP Insure will be offered

- Reliance Growth Fund -- Retail Plan

- Reliance Vision Fund -- Retail Plan

- Reliance Equity Opportunities Fund -- Retail Plan

- Reliance Equity Fund -- Retail Plan

- Reliance Equity Advantage Fund -- Retail Plan

- Reliance Regular Savings Fund -- Equity option

- Reliance Regular Savings Fund -- Balanced Option

- Reliance Banking Fund -- Retail Plan

- Reliance Pharma Fund

- Reliance Media & Entertainment Fund

- Reliance Diversified Power Sector Fund -- Retail Plan

- Reliance Natural Resources Fund -- Retail Plan

- Reliance Quant Plus Fund -- Retail Plan

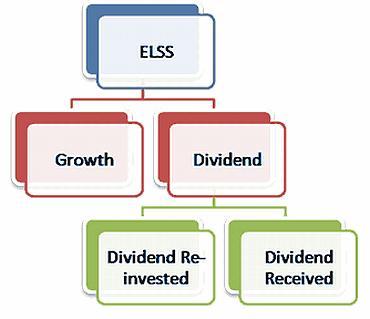

- Reliance Tax Saver (ELSS) Fund

- Reliance Long Term Equity Fund

- Reliance Smallcap Fund

- Reliance Infrastructure Fund- Retail Plan

Click NEXT for more

Reliance SIP + Insure: Should you invest?

According to Reliance Mutual Fund, under Reliance SIP Insure, the investors are provided life insurance cover without any extra cost under a Group Term Insurance scheme.

The life insurance cover under 'SIP Insure' facility will be enhanced as per the following clauses:

An amount equivalent to the aggregate balance of unpaid SIP installments, subject to a maximum of Rs 10 lakh per investor across all schemes / plans and folios will be invested in the nominee's account.

The amount of life insurance cover shall be invested in the nominee's account in the same scheme under which the deceased investor has enrolled for SIP Insure at the applicable price based on the closing NAV on the date on which the cheque for insurance claim settlement is received by the AMC from the insurance company, subject to completion of requisite procedure for transmission of units in favour of the nominee.

Click NEXT for more

Reliance SIP + Insure: Should you invest?

Eligibility:

- All individual investors enrolling for investments via SIP & opting for 'Reliance SIP Insure'

- Only individual investors whose completed age is between 18 years & 45 years (inclusive of both) at the time of investment

- In case of multiple holders in the any scheme, only the first unit holder will be eligible for the insurance cover

Investment details:

- Minimum investment per installment: Rs 1,000 per month & in multiples of Re 1 thereafter. (Except for Reliance Tax Saver (ELSS) Fund where minimum installment is Rs 1,000 per montth and in multiples of Rs 500 thereafter). There is no upper limit

- Minimum period of contribution: Three years and in multiples of one month thereafter

- Mode of payment of SIP installments is only through direct debit & ECS (post dated cheques shall not be accepted )

- Maximum period of contribution: No upper limit for SIP tenure. The investor can opt for perpetual SIP also. However the insurance cover ceases when the investor attains 55 years of age or upon the completion of the SIP insure tenure whichever is earlier

Click NEXT for more

Reliance SIP + Insure: Should you invest?

Commencement of insurance cover

The insurance cover shall commence after the "waiting period" of 90 days from the commencement of SIP installments. However, the waiting period will not be applicable in respect of accidental deaths.

Cessation of insurance cover

The insurance cover shall cease upon occurrence of any of the following:

- At the end of mandated Reliance SIP Insure tenure. That is, upon completion of payment of all the monthly installments as registered or till attaining 55 years of age, whichever is earlier

- Discontinuation of SIP installments midway by the investor, that is, before completing the opted SIP tenure /installments or till attaining 55 years of age, whichever is earlier

- Redemption / switch-out of units purchased under Reliance SIP Insure before completion of the mandated SIP tenure / installments or till attaining 55 years of age, whichever is earlier

- In case of default in payment of two consecutive monthly SIP installments or four separate occasions of such defaults during the tenure of the SIP duration chosen or till attaining 55 years of age, whichever is earlier

Note: There is no provision for revival of insurance cover once the insurance cover ceases as stated above

Exclusions for insurance cover

No insurance cover shall be admissible in respect of death of the SIP-Insure unit-holder (the insured person) on account of:

- Death due to suicide

- Death due to pre-existing illness, disease(s) or accident which has occurred prior to the start of cover

- Death within 90 days from the commencement of SIP installments except for death due to accident

Click NEXT for more

Reliance SIP + Insure: Should you invest?

Load structure

- There will an exit load of 2%, if the accumulated units acquired or allotted under Reliance SIP Insure are redeemed or switched out or the SIP Insure is discontinued or it is defaulted before the maturity of committed SIP Insure tenure or before completion of 55 years of age whichever is earlier as opted in the respective scheme either by the SIP-Insure unit-holder or by the nominee, as the case may be

- Upon completion of 55 years of age, if there are still balance unpaid SIP installments, those will be treated as normal SIP with the relevant exit load as may be existing from time to time. In the event of the death of the investor and the redemption by the nominee, before completion of SIP Insure tenure or before attaining 55 years of age, there shall be an exit load of 2% on the repurchase of units

Click NEXT for more

Reliance SIP + Insure: Should you invest?

Reduced insurance cover with every passing SIP installment?

Let's first look at the insurance aspect which differentiates this offering from the rest available in the market.

Insurance in the scheme basically reduces with every passing SIP installment as insurance cover is equal to remaining SIP payment.

For instance, an investor does a monthly SIP of Rs 10,000 for 5 years in Reliance Growth Fund. If s/he dies after a period of 3 years, then her/his sum assured = unpaid SIP installments = 2 years (5 years minus 3 years) X 12 months X 10,000 = Rs 2,40,000.

In addition maximum insurance an investor can get under this scheme can get is Rs 10 lakh across all schemes / plans and folios invested by investor. We believe that with Rs 10 lakh cover, you still will require a pure term plan of much higher cover depending on your individual requirement. Ideally, insurance cover should be around 8 to 10 times of your annual income.

Click NEXT for more

Reliance SIP + Insure: Should you invest?

Mutual fund as an insurance instrument

We believe that when an investor is investing in an equity mutual fund for a period of 10-15 years, his/her aim is long term wealth creation. Investors should not invest in a scheme because it is offering insurance attached to it. Investment in mutual funds should be looked upon as a pure investment avenue and not a medium to get so called free insurance but surely insufficient one for majority of investors.

If for some reason after a couple of years into the scheme, investor needs to discontinue the SIP, his/her's insurance cover will cease leaving him/her without much required life insurance policy. In addition, availing a life insurance policy at a later stage can prove very costly.

Click NEXT for more

Reliance SIP + Insure: Should you invest?

Scenarios of cessation of insurance cover

In addition, make sure you remember that your insurance under the scheme can be discontinued on discontinuation of SIP installments midway by the investor, redemption / switch-out of units purchased under Reliance SIP Insure before completion of the mandated SIP tenure / installments or default in payment of two consecutive monthly SIP installments or four separate occasions of such defaults during the tenure of the SIP duration chosen. So in one way scheme presses upon investors to continue the complete initial duration investor has chosen irrespective of how fund performs in the long run.

Hefty exit load

Don't ignore 2% exit Load under this scheme -- Though we always recommend investors to invest consistently in a single good performing fund for long duration. Many funds such as Franklin India Bluechip, HDFC Equity, HDFC Top 200 has performed phenomenally well over a duration of 10-15 years but the number of such consistent performers are quite less as compared to funds launched in the market. If the scheme starts to underperform benchmark index consistently for substantial number of quarters running, then it is highly likely that investor will discontinue the scheme and hence will attract exit load.

In addition, in the event of the death of the investor and the redemption by the nominee, before completion of SIP Insure tenure or before attaining 55 years of age, there shall be an exit load of 2% on the repurchased units.

Click NEXT for more

Reliance SIP + Insure: Should you invest?

No pre-existing diseases covered

No insurance cover shall be admissible in respect of death of the SIP-Insure unit-holder (the insured person) on account of pre-existing illness, disease(s) or accident which has occurred prior to the start of cover.

The bottom line

Make sure you don't fall into the trap of life insurance offered as part of this scheme. Irrespective of any scheme, do remember mutual fund is an investment instrument and a fund facts and figures should be the fundamental reason for investing in a specific fund. Also on insurance aspect, the maximum cover offered is way too less than majority of investors will require.

In addition, binding yourself to a fund for insurance cover won't be prudent choice. Paying high exit load will be only option if fund performs miserably -- so a triple blow (no insurance, poor fund performance, hefty exit load) will be in the offering.

Remember basic investment mantra

Don't mix your investment and insurance portfolios.

Go for a pure 'term plan' with adequate life cover to fulfill your insurance needs and invest selectively in good mutual funds for wealth creation. Keeping simple and clear investment strategy always pays rich dividends in long run.

In a nutshell, we will recommend readers to avoid this scheme and invest in SIP without any insurance cover attached to it so as to have clarity in mind about their insurance and investment portfolio.

Comment

article