Photographs: Rediff Archives Travel smart with prepaid travel cards

Are you a frequent traveller abroad and are constantly concerned about the currency you are carrying with you? Well you needn't be anymore.

Here are prepaid travel cards which serve as a great alternative to carrying currency, whether you are on a business or a pleasure trip. Hassle-free and secure, these cards offer unmatched global convenience. You wouldn't really need to stack up those travellers' cheques and currency notes in your baggage anymore.

So leave your worries behind, and just enjoy your trip.

Click NEXT for more

Travel smart with prepaid travel cards

Prepaid travel card: How does it work?

As the very name suggests, prepaid travel card is one in which you load the currency of your choice, at the time of its purchase, prior to your travel.

During the course of your travel, the card could be used for overseas cash withdrawals at ATMs, or to swipe at merchant establishments.

The card could be used up to the amount that has been loaded on it, and with each transaction that is made, the value on the card decreases. It could be used till the availability of funds on it.

In case you are travelling to more than one country on a single trip, you would need to ask the bank to issue more than one card to you, in different currencies, within the overall RBI approved limits for the trip.

It is not possible to load more than one currency on a single card. For cash withdrawals at ATMs, the card would dispense the local currency. Say for example, you have loaded US dollar on the card, and are using it in Europe, the local currency (Euros) would be dispensed and Visa conversion charges from USD to Euro will be applied.

Click NEXT for more

Travel smart with prepaid travel cards

Key features of a travel card

- Reduces the burden of carrying large amounts of forex during travel

- Works out as a cost effective option in comparison to regular international debit/credit cards, which charge up to 3.5% of the transacted amount

- Cards are mostly reloadable with currency for additional requirements

- Some banks offer a locked in exchange rate benefit that prevent exchange rate fluctuations

- The cards are backed by either MasterCard or Visa, making them widely accepted across the globe

- Availability of online access of transaction and balance details

- Some banks offer additional benefits such as multiple insurance benefits including personal accident, loss of travel documents etc...

Click NEXT for more

Travel smart with prepaid travel cards

Documents required for a travel card

Banks issue travel cards to both their existing customers as well as to non-customers, on producing the following documents:

- Copy of passport/visa

- Copy of confirmed tickets

- Copy of PAN card / Form 60

- Form A2: Statement of purpose of your visit

- Declaration that you haven't exceeded your $10,000 yearly foreign exchange quota

To purchase a travel card, you would need to pay the bank in Indian rupees. Charges are deducted for this facility by the bank. The amount in foreign currency is then loaded on to the card, at the prevailing exchange rate as on the date of purchase.

Click NEXT for more

Travel smart with prepaid travel cards

Card validity

Travel cards are generally valid for five years. Any unutilised balance on the card could be encashed in Indian rupees before the expiry of the card, at the exchange rate prevailing on the date of encashment.

Charges applicable on the card

The following charges are levied by banks issuing travel cards. Such charges vary from bank to bank.

- Card issuance charge: Anywhere between Rs 110 to Rs 250

- Reload charges: Any further currency reloading charges range between Rs 50 to Rs 100 per reload

- ATM withdrawals: Around USD 1.5 to USD 2 per withdrawal. There is however no charges on using the card at merchant establishments.

Foreign exchange limit on the card

The Reserve Bank of India has stipulated a limit of USD 10,000 on foreign exchange for personal international travel and up to USD 25,000 if it is an international business travel. This limit holds good for prepaid travel cards too.

Click NEXT for more

Travel smart with prepaid travel cards

Image: Standard Chartered Bank: Smart Travel Prepaid CardTravel cards available in the market

Almost all major banks offer travel cards. Here is a quick snapshot of a few of them:

Standard Chartered Bank: Smart Travel Prepaid Card

- Gold MasterCard

- Benefits include shopping, hotel, airlines, car rentals and chauffeured transport

- Currencies available are USD, Euro and GBP

- Minimum issue amount: 500 USD, 500 EUR and 250 GBP

- Free cash withdrawal on Mastercard ATMs (only for certain amounts of upload)

- Complimentary international SIM card

Click NEXT for more

Travel smart with prepaid travel cards

Image: State Bank of India: Vishwa Yatra CardState Bank of India: Vishwa Yatra Card

- Visa card

- Travel and lifestyle benefits

- Available currencies USD, Euro, Yen, Canadian Dollar (CAD), Australian Dollar (AUD) and GBP

- Minimum issue amount of 500 USD, 400 EUR, 500 CAD, 50,000 YEN, 500 AUD and 250 GBP

- Free balance enquiry at State Bank Group ATMs

Click NEXT for more

Travel smart with prepaid travel cards

Image: ICICI Bank: Travel CardICICI Bank: Travel Card

- Available options of Visa, MasterCard and Amex

- Visa card is available in US Dollars, Australian Dollars, Canadian Dollars, Swiss Francs, Euros, British Pound, Singapore Dollar and Japanese Yen

- Emergency medical assistance during travel

Click NEXT for more

Travel smart with prepaid travel cards

Image: HDFC Bank: Forex PlusHDFC Bank: Forex Plus

- Option of both Visa and MasterCard

- Available in Australian Dollar, AED (Dirhams), Canadian Dollar, Euro, Japanese Yen, Singapore Dollar, Sterling Pound, Swiss Franc and US Dollar Currencies

- Personal accident insurance c of Rs 2 lakh, loss of checked baggage cover up to Rs 20,000 and Passport Reconstruction Cover

Click NEXT for more

Travel smart with prepaid travel cards

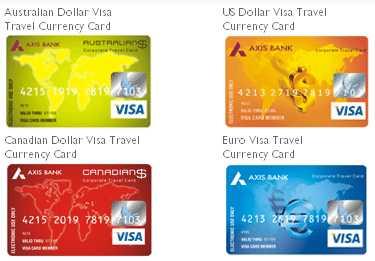

Image: Axis Bank: Travel Currency CardAxis Bank: Travel Currency Card

- Visa and MasterCard Option

- 9 currencies US / Australian / Canadian / Singapore Dollars, Euros, Sterling Pounds, Swiss Francs, Swedish Kroner, Japanese Yen, Dirhams and Saudi Riyal variants are available currencies on VISA platform. The US Dollar variant is also available on MasterCard platform

- Minimum Amounts USD-250; EURO-200; GBP-150; AUD-300; CAD-300; SGD-350; CHF-300, SEK-1500, JPY 30000, AED 950 and SAR 950

Click NEXT for more

Travel smart with prepaid travel cards

Image: Citibank: World Money CardCitibank: World Money Card

- Visa Card

- Available Currencies US Dollars, Pounds Sterling, Euros, Australian Dollars, Singapore Dollars and Canadian Dollar

- Complimentary Fraud Protection Insurance

- Complimentary International Calling Card

Comment

article