Photographs: Rediff Archives Larissa Fernand, Fundsupermart.co.inFundsupermart.co.in

On June 30, 2012, one of the national media publications in our country gushed over Shiva Thapa. "With boyish exuberance he is all set to take on the world," was one of the observations they recorded. After India's boxing sensation lost to Mexico's Oscar Valdez Fierro, the newspaper spoke about his "severe beating".

The magazine First Post picked up the issue of media coverage. The result was a terse, but very interesting, piece on how the imaginative headlines and reports in various publications did not do the fight justice and the 18-year old showed "tremendous guts and ferocity against a vastly experienced opponent" and "no one gave the brave 18 year old a 'severe beating'".

For those who had not seen the match but devoured all the media reports, the impression in their minds would have undoubtedly been conflicting. And this is exactly what investors feel when they read the mixed signals of the India growth story.

On the one hand, we are fed the notion that the Indian economy has been struck with a bad case of whiplash and the future looks grim, at best. The opposing view doled out is that the country will once again take the growth path and reclaim its status as a vibrant economy.

Such uncertainty would naturally make investors squeamish, if not paranoid, about where to tuck their wealth. Which, in turn, forces a perverse reaction onto the market as investors take refuge in fixed return instruments, the most popular being term deposits.

In such ambiguity, ignore the noise for the moment and tackle plain numbers.

Equity vs fixed deposits: Why equity WINS!

Photographs: Rediff Archives

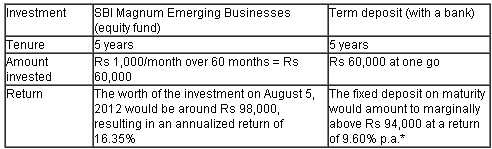

Let us assume that you invested in a term deposit five years ago. At the same time you started a started a systematic investment plan (SIP) in a mutual fund. What would have been the outcome today?

The investment in equity gained over all fronts. Why?

Though the amount invested in both cases was Rs 60,000, the investment in the fund scored because you did not have to put down that amount at one go. There was no strain on your finances. Instead, you disciplined yourself into investing every month over 60 months!

In the case of the fixed deposit, you had to part with that much of cash at one instance.

Note: According to data provided by the Reserve Bank of India (RBI), term deposit rates of major banks for more than one-year maturity in July 2007 were in the range of 7.50.60 per cent. We went with the highest rate.

Equity vs fixed deposits: Why equity WINS!

Photographs: Rediff Archives

On maturity, you do not have to pay any long-term capital gains tax on your mutual fund investment if you hold the units for a year before selling. In the case of the term deposit, you would be taxed according to the income bracket you fall under.

If you fall in the highest tax bracket of 30 per cent, out of the interest you earn in the above illustration, a little more than 10,000 would go in taxes.

No matter the turmoil the equity market faces, in the end investments in good businesses will deliver. If you invest and stay grounded in a good equity fund (note, the catch here is to invest wisely, not blindly), you stand to win over the long term. Despite a term deposit giving the impression of a safe haven, it will turn out to be a losing proposition once you take taxes and inflation into account.

The jury is out on this one!

Comment

article