With these you can rest assured that your investment amount is not washed away

The Indian investment market offers a plethora of investment avenues. However the asset class that an investor chooses has to primarily do with the risk appetite of the investor. Every investor looks for a certain element of safety before investing -- a kind of assurance that even in the case of unfortunate market events s/he at least gets back the capital invested.

A higher level of safety comes with a 'cost': investors will have to compromise on the returns front, as one cannot expect higher safety with higher returns.

Returns offered by low risk investments will be low to moderate i.e. up to 9 per cent and in some cases the post tax returns would be even lesser. It would hence be ideal if an investor can have a mix of asset classes with varying degrees of risk, to address safety and returns.

Anil Rego is the founder and CEO of Right Horizons (http://www.righthorizons.com/), an investment advisory and wealth management firm that focuses on providing financial solutions that are specific to customer needs.

7 safe investment options for beginners

Photographs: Rediff Archives

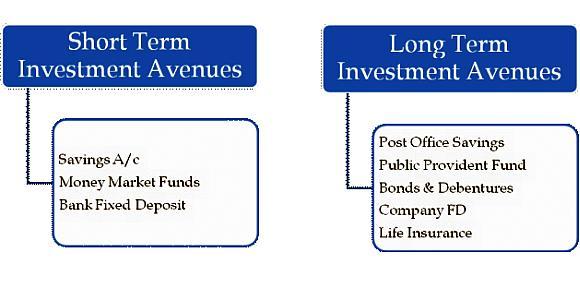

Short-term avenues

1. Savings bank account

This is the primary savings product that anyone would have; however it provides low returns of 4 o 5 per cent. Any funds in this account makes sense only if the balance is sufficient to cover needs that are supposed to arise within a month as it offers highest liquidity.

One can withdraw the funds required at any given point of time through multiple modes i.e. direct withdrawal from bank and through ATMs; also with the enhancement in banking facilities one can transfer the required funds via electronic mode too.

7 safe investment options for beginners

Photographs: Rediff Archives

2. Money market/Liquid funds

Money market funds are mutual fund schemes which invest in short term instruments that are liquid. Their main objective is to safeguard the capital and then look out for returns. They offer higher returns as compared to SB accounts.

3. Fixed deposit schemes (Bank FD)

Bank FD comes with a fixed tenure of investment which acts like a lock in period.

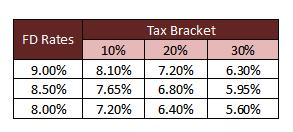

While early withdrawal is possible it entails a 'penalty'. It is essential to 'plan' this investment since it comes with a fixed tenure/lock in. This avenue may not yield good returns for investors who are in higher tax brackets...

7 safe investment options for beginners

Photographs: Rediff Archives

Long-term avenues

4. Post office savings schemes

This is one of the favourite and most sought after among investors who believe in regular savings in the form of recurring deposits. There are other options like National Savings Certificate, PO time deposit which are similar to FD and also offer tax benefit u/s 80 C if the tenure is 5 years.

It also offers an investment avenue for senior citizens with higher rates as compared to what is offered to the general public.

5. Public Provident Funds (PPF)

PPF offers multiple benefits of good returns @ 8.8 per cent, low risk, tax free interest and tax benefit u/s 80 C. However liquidity in this avenue is low, as one can start withdrawing only from the seventh financial year onwards and has to adhere to certain limitations while withdrawing.

PPF can be planned for long-term needs arising after 12 to 15 years like retirement income, children's education/marriage needs.

7 safe investment options for beginners

Photographs: Rediff Archives

6. Bonds and debentures

Bonds and debentures are other lucrative investment options available. Bonds which get listed on the secondary market offers dual benefit -- firstly, fixed interest income in form of coupon rates and secondly, capital appreciation if any -- since bond value can appreciate based on prevailing market conditions and interest rates.

There are different categories of bonds like tax-free bonds where interest income from the same is exempted from tax. Such bonds offer 7 per cent to 9 per cent per annum tax free returns; one can consider investing in the same for regular income payouts.

Section 54 EC also provides an investment opportunity in bonds for saving capital gains made through sale of property, however interest on such bonds is quite low -- approximately 6 per cent.

7. Company FDs

Companies too are allowed to issue fixed deposits, however the risk associated with the same will be higher as compared to the risk associated with bank fixed deposit. Before investing in the same investors need to analyse the company and its credit worthiness in order to evaluate the risk associated with their investments.

Key takeaways

- Choose the avenue that best suits you

- Returns should not be the sole criterion for investing

- One need to evaluate factors like the term and the associated lock in if any

- Asses the risk associated with the same

Comment

article