ELSS, or tax savings funds, are diversified equity funds that offer a benefit under Section 80C. Here's how to make sure you invest smartly.

One of Morningstar's readers, Anand Monickam, informed me that his entire Section 80C investments were channelised to the Public Provident Fund for the financial year gone by. This year, he plans to be more diligent and is starting his tax planning this very month, specially since he wants to invest in equity linked savings schemes. Very smart move!

Implementing one's tax planning strategy at the very start of the financial year is all the more relevant in the case of equity linked savings schemes, or ELSS.

Being diversified equity funds, it would make immense sense to start right away via a systematic investment plan, or SIP.

One need not extol the virtues of systematic investment, they are well known. But I will say that since you are investing in a market-related investment, it is best to distribute it over 12 months rather than a lumpsum at the end of the financial year.

As with any fund investment, when narrowing down on a pick, an error investors are prone to make is opting for the most recent chart topper.

Despite the bold disclaimers about past performance not necessarily being sustained in the future, investors have a hard time resisting that lure. And when that is employed as a sole parameter, it's not uncommon for disillusionment to set in rapidly.

A very in-your-face example would be Taurus Tax Shield.

In 2007, it was the best performer in its category with a return of 112 per cent, way ahead of the average 57 per cent. Investors who went for it simply because of the great performance in 2007 would have been a disappointed lot.

Barring 2009, the fund has underperformed the category average every other year. But had they done their homework, they would have seen that the fund was the worst performer in its category in 2006.

When looking at past performance, pay a lot of attention to consistency. Don't get swayed by a sporadic burst in numbers.

For instance, HSBC Tax Saver put its best foot forward in 2012. But a look at the performance prior to that year is far from impressive.

Ditto with its 2013 returns. On the other hand, Axis Long Term Equity has been fairly consistent. It has been the best performer in its category in 2010, 2011 and 2013.

Even when it missed this coveted spot in 2012, its performance was better than that of the category average.

Here are a few tax-saving funds, or equity linked saving schemes, that Morningstar analysts have looked at.

Kindly click NEXT to continue reading

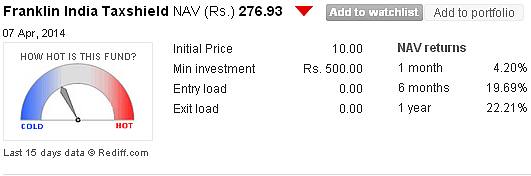

Franklin India Taxshield

Analyst rating: Gold (To know more about Analyst ratings, click HERE)

Star rating: 4 (To know more about Star ratings, click HERE)

Fund manager Anand Radhakrishnan adopts a bottom-up investment style with a bias for large-cap stocks.

His contrarian bent results in the portfolio standing out when compared to that of the typical peer.

Kindly click NEXT to continue reading

HDFC TaxSaver

Analyst rating: Silver

Star rating: 4

Vinay Kulkarni aims to derisk the portfolio by investing in uncorrelated sectors of the economy. Though the fund plies a multi-cap approach, he pays more attention to smaller caps than the typical category peer.

His holdings tend to remain fairly consistent over long time periods, which is borne out by the fund's low turnover ratio. However, he does tend to take big bets which could result in underperformance in the short term.

Kindly click NEXT to continue reading

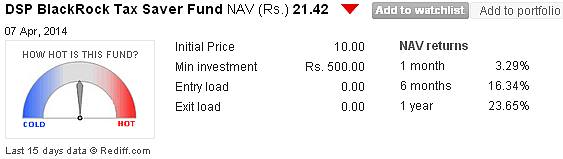

DSP BlackRock Tax Saver

Analyst rating: Bronze

Star rating: 4

The fund's sector weights can deviate by a maximum of 15 per cent (absolute) as compared with the benchmark CNX 500's weights, with no particular bias to any market cap.

To prevent concentration risk in a particular sector or market cap, Apoorva Shah ensures that individual stocks usually account for less than 5 per cent of the fund's assets, and the top 10 stocks account for roughly 35 per cent, compared with 50 per cent for a typical peer.

Kindly click NEXT to continue reading

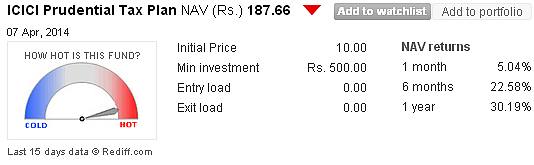

ICICI Prudential Tax Plan

Analyst rating: Neutral

Star rating: 4

Chintan Haria is valuation conscious and uses a combination of top-down and bottom-up approaches to create a multi-cap portfolio. He maintains a fairly diversified portfolio and aggressively trades in the large-cap space.

Haria's stock-picking style is flexible, allowing both growth as well as value-styled picks. However, valuations play an important role as he avoids investing in expensive stocks/sectors even in his growth picks.

Kindly click NEXT to continue reading

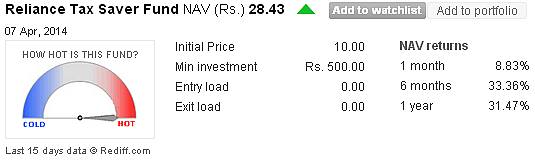

Reliance Tax Saver

Analyst rating: Neutral

Star rating: 3

Ashwani Kumar typically scouts for companies with strong growth prospects that he believes are trading at a discount to their intrinsic value.

He takes sizeable positions in smaller caps in the quest to deliver superior returns. Our analyst is of the view that the combination of substantial small/mid-cap exposure and big stock/sector bets make the fund an apt supporting player in a tax-saving portfolio.

Kindly click NEXT to continue reading

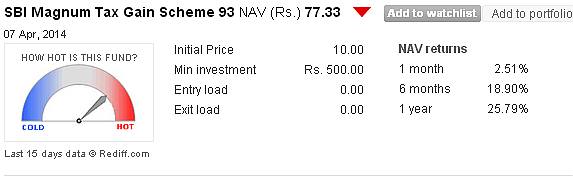

SBI Magnum Taxgain Scheme 93

Analyst rating: Neutral

Star rating: 4

Until 2011, manager Jayesh Shroff freely took active positions versus the benchmark index S&P BSE 100 as per his convictions.

Since 2011, Shroff has been plying a benchmark-aligned growth-oriented approach in place of the erstwhile benchmark-agnostic process.

As per the new strategy, the portfolio's sector weights are loosely aligned with those of the benchmark. He focusses on growth stocks and largely follows a buy-and-hold approach.

Click on MORE to see another feature...