Photographs: Dominic Xavier/Rediff.com Morningstar.in

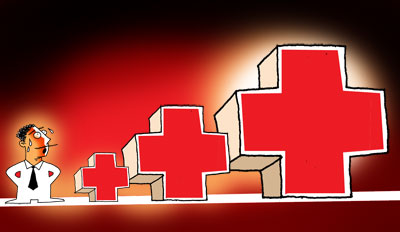

It is just not enough to select a life insurance company that is known for its high claim settlement ratio. The responsibility also rests with you to ensure that you play it right so that your claim is not rejected.

Before we talk about the four common reasons why your claim could get rejected you must know what a claim settlement ratio is.

For beginners, claim settlement ratio refers to the total number of death claims settled by an insurance company.

The calculation is done by dividing the total number of death claims received by the total number of them settled.

For instance, if a life insurance company receives 1000 death claims and settles 980, the claim settlement ratio of that company would be 98 per cent. The higher the claim settlement ratio of the company, the more favourable it would be for individuals.

Now for the four reasons...

Please click NEXT to continue reading

1. Non-disclosure of facts

Photographs: Dominic Xavier/Rediff.com

The policy document is based on facts and information provided by the policyholder.

Any misstatement or incorrect data provided by the individual at the time of buying the policy could lead to the claim being rejected.

For instance, if death takes place due to a pre-existing medical condition that was not reported at the time of purchase of the policy, the claim could get rejected.

Be honest. It will hold you in good stead.

Please click NEXT to continue reading

2. Death due to certain circumstances

Photographs: Dominic Xavier/Rediff.com

Listed below are some incidents which, if resulting in the death of a policyholder, put payment to the beneficiary into doubt:

- Drug overdose

- Addiction or misuse of non-prescription drugs

- Death in an accident where the policyholder is found to be intoxicated

- Suicide

If the cause of death mentioned on the death certificate is 'homicide', then the insurance company will follow up with the police investigation to ensure that the beneficiary is not a suspect.

If yes, then the payout will be held back until the charges are dropped or the beneficiary is acquitted.

Also check for death due to war and terrorist activities.

There are numerous instances where the death of the policyholder will bring into doubt the payment to the beneficiary or may result in just part payment. Be sure you are well aware of what they are.

Please click NEXT to continue reading

3. Time of death

Photographs: Dominic Xavier/Rediff.com

If death has occurred right after the policy has been taken, it will be viewed as extremely suspicious by the insurance company.

In such an instance, payment will most probably not be made. Even if death occurs within a year or so after taking the policy, the insurance companies tend to be mistrustful.

Worth noting is that life insurance companies have a contestability period which could range from 12 months to 2 years.

The clock starts ticking as soon as a policy goes into effect.

During this period, the company can cancel the coverage and return the premium if they believe that the policyholder has withheld crucial information or has deliberately lied.

When you buy a policy, check whether death occurring during this period will be an issue.

Please click NEXT to continue reading

4. Policy has lapsed

Photographs: Dominic Xavier/Rediff.com

Be regular with your premiums.

If, by any chance, you have not paid up and your policy has lapsed, then there is no way the insurance company is obligated to make the payment to your beneficiary.

If you miss a premium payment, look out for the grace period.

If you have missed that, then talk to the company to once again re-instate your policy on making a penalty payment.

Comment

article