Photographs: Dominic Xavier/Rediff.com Himanshu Srivastava

Debunking some common notions that muddy the investment waters.

Myth I: I am too young to invest

Alright, let's get this straight. You are never too young to start saving, unless of course you are the offspring of one of the world's richest billionaires.

In that case, you probably need never bother saving. If you are not so fortunate, read on.

Let's say you want to have Rs 10 lakh by 2024. With a return of 10 per cent per annum, you would need to save Rs 4,840/month. Should you delay this savings process by just 2 years, you would need to increase your savings by Rs 6,784/month.

And, if you took up the savings route 5 years down the road, as against right now, you would need to save a hefty Rs 12,807/month.

Got the picture? The more time you have on your hands, the smaller the amount you have to periodically tuck away towards achieving your goal.

Please click NEXT to continue reading

Myth II: Long-term investing always pays

Photographs: Uttam Ghosh/Rediff.com

Not if you buy junk. Time does not magically transform a bad investment into a good one.

Not for a moment are we understating the importance of a long-term perspective, specially when dealing with equity and equity-oriented funds.

But a long-term horizon cannot be viewed in isolation.

Long-term investing can be counterproductive if the fund you have invested in is a poor performer.

A long passage of time won't automatically eliminate the fund's shortcomings.

Sector funds, for instance, with a narrow investment universe, tend to deliver at their best when the underlying sector hits a purple patch. Over longer time frames, they may not be a good fit for your portfolio.

Instead of blindly staying married to such an investment, it would make sense to cut your losses and move your money into a more productive offering.

Please click NEXT to continue reading

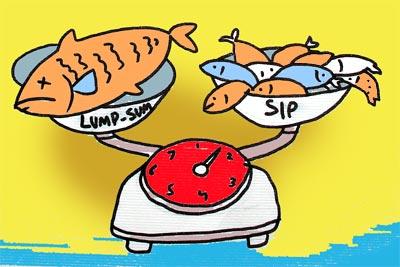

Myth III: Systematic investing always works

Photographs: Dominic Xavier/Rediff.com

This would certainly grab your attention.

We most certainly recommend a systematic investing plan, or SIP, when investing in equity mutual funds over the long term.

It entails investing a small sum every month vis-a-vis investing a lump sum. The advantage is that it enforces discipline and consistency in investing.

Also, the investor has to part with just small sums of money every month.

SIP works on the philosophy of rupee-cost-averaging. This means that the money invested will buy more mutual fund units when its net asset value, or NAV, is low and fewer units when its NAV is high, thereby lowering the average cost per unit over time.

Despite all the obvious benefits, the SIP route does not always deliver higher returns vis-a-vis lump sum investing.

This strategy would typically work best during times of market volatility.

But if equity market is experiencing a secular bull-run, the returns from SIP would lag vis-a-vis lump sum investing since the investor buys lump sum at a lower price rather than "averaging upwards" through the SIP route.

So while systematic investing has its advantage of enforcing a savings over all market upheavals and downturns, to benefit from it you must stay invested over a long time frame or have an investment horizon spanning over at least a market cycle.

Comment

article