- Did you lose your job?

- Are you planning a new job or new venture?

Wherever you are, whatever you may be thinking of, I would like to share with you a small message from Robert Kiyosaki's book Guide to Investing which inspired me. The author has given several important lessons but the one which I want to highlight now is Investor Lesson 11: On Which Side of the Table Do You Want to Sit?

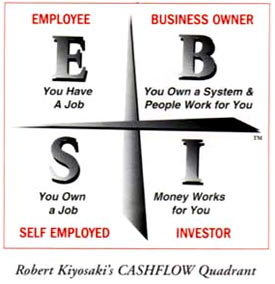

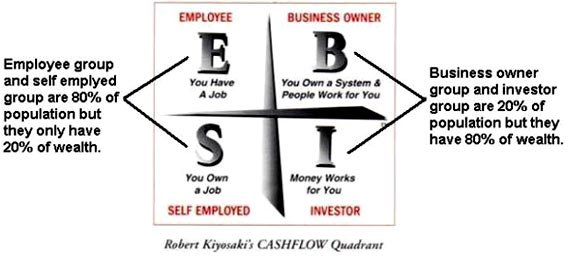

Kiyosaki narrated a conversation with his 'Rich Dad' who explains him the 'Cashflow Quadrant'. Here's how Rich Dad makes his son understand how times keep changing and what he must do to cope with changing times:

Rich Dad again drew the Cashflow Quadrant

Rich Dad believed that most people focus on only one side of the Quadrant, that is, either E or S. The B and I side of the quadrant is always an afterthought. Most people want to play safe in life and go for a job which provides security.

Rich Dad believed that most people focus on only one side of the Quadrant, that is, either E or S. The B and I side of the quadrant is always an afterthought. Most people want to play safe in life and go for a job which provides security.

In other words they want the company to be responsible for their long-term investment needs. This scenario will change soon, Rich Dad had predicted in the book.

If we look at the present scenario we would agree how accurate Rich Dad was. The rules have changed and the thought of job security which prevailed earlier no longer holds good today.

Rich Dad also explained his point by saying that we have entered a phase of global economy. And for companies to compete in the world, they need to get their costs down. And one of their major costs is employee compensation and employee retirement plan funding. He said to Kiyosaki, "You mark my words, in the next few years businesses will begin shifting the responsibility of investing for retirement to the employee. By the time you are my age, what to do with people without financial and medical support when they are older will be a massive problem. And your generation, the Baby Boomer generation, will probably be tasked with solving that problem. The severity of this problem will be very prominent sometime around 2010."

Rich Dad's Guide to Investing was published by Warner Books in June 2000. This shows that the author had envisaged the present situation then. In the same book Robert Kiyosaki gets serious about this issue and asks Rich Dad a solution for the same. Rich Dad says that Robert should make the I quadrant the most important quadrant, not the others.

He asks Robert to choose to be an investor when he is grown up. Rich Dad believed you must want to have your money working for you so you don't have to work if you don't want to, or cannot work.

The rules have indeed changed ever since Rich Dad made his prophecy in 2000.

In the Information Age of today, most of us need greater financial sophistication. We need to know the difference between an asset and a liability. We are living much longer and therefore need more financial stability for our retirement years.

Rich Dad used to say "If your home is your biggest investment, then you're probably in financial trouble. Your financial portfolio needs to be a much bigger investment than your home."

He often gave a practical example to Kiyosaki that when a major company announces a lay off of thousands of employees, the company's share price often goes up. That is an example of the two sides of the table. When a person shifts to the other side, his or her point of view of the world also changes.

In this book, Robert Kiyosaki shows how anyone can get started and how it does not take money to make money. He teaches how time is more important than money; how investing in one's self and getting an education and experience precedes excessive cash; how having a plan is more important than being in a hurry to make money.

Today is the time when you should act on these basic financial principles and get yourself prepared for the change.

Decide on which side of the quadrant you would like to see yourself tomorrow. Have the dedication to reach the right quadrant and be prepared to enhance your financial skills for the same.

Priyesh Shah works as a CFP at SRE Financial Planners. He can be reached at priyeshcfp@rediffmail.com.